As Filed Pursuant to Rule 424(b)(3)

Registration No. 333-263627

PROSPECTUS SUPPLEMENT NO. 8

To Prospectus Dated May 5, 2022

This prospectus supplement (this “Supplement No. 8”) is part of the prospectus of BRC Inc. (the “Company”), dated May 5, 2022 (as previously supplemented, the “Prospectus”), which forms a part of the Company’s Registration Statement on Form S-1 (Registration No. 333-263627). This Supplement No. 8 supplements, modifies or supersedes certain information contained in the Prospectus, with the information set forth below and contained in the Company’s Current Report on Form 8-K attached hereto, filed with the Securities Exchange Commission on December 30, 2022 (the “Current Report”). Any statement in the Prospectus that is modified or superseded is not deemed to constitute a part of the Prospectus, except as modified or superseded by this Supplement No. 8. Except to the extent that the information in this Supplement No. 8 modifies or supersedes the information contained in the Prospectus, this Supplement No. 8 should be read, and will be delivered, with the Prospectus. This Supplement No. 8 is not complete without, and may not be utilized except in connection with, the Prospectus.

This Supplement No. 8 amends the information set forth in the table under the heading “Selling Holders” in the Prospectus as follows, following the occurrence of certain distributions:

| · | Deletion of the line items: |

Securities

Beneficially Owned | Securities

to be Sold in This | Securities

Beneficially Owned After | ||||||||||||||||||||||||||||||

| Name of Selling Holders | Shares of | Warrants(2) | Shares of | Warrants(2) | Shares of | % |

Warrants(2) | % | ||||||||||||||||||||||||

| Sage Enterprises, LLC(27) | 6,612,821 | — | 6,612,821 | — | — | — | — | — | ||||||||||||||||||||||||

| Logan Stark(48) | 739,157 | — | 739,157 | — | — | — | — | — | ||||||||||||||||||||||||

| · | and addition of the following line items: |

Securities

Beneficially Owned | Securities to be Sold in This |

|

|

|

Securities Beneficially Owned After | |||||||||||||||||||||||||||

| Name of Selling Holders | Shares of | Warrants(2) | Shares of | Warrants(2) | Shares of | % |

Warrants(2) | % | ||||||||||||||||||||||||

| Sage Enterprises, LLC(27) | 5,282,821 | — | 5,282,821 | — | — | — | — | — | ||||||||||||||||||||||||

| Logan Stark(48) | 686,485 | — | 686,485 | — | — | — | — | — | ||||||||||||||||||||||||

| Orvis Charitable Remainder Trust(166) | 1,330,000 | — | 1,330,000 | — | — | — | — | — | ||||||||||||||||||||||||

| Raymond James Charitable Endowment Fund(167) | 8,000 | — | 8,000 | — | — | — | — | — | ||||||||||||||||||||||||

| (27) | Consists of 5,282,821 shares of Class A Common Stock issuable upon the exchange of Common Units and the surrender and cancellation of a corresponding number of shares of Class B Common Stock. Jayson Orvis may be deemed to be the beneficial owner of the shares reported by such entity. Mr. Orvis disclaims any beneficial ownership of the shares reported by such entity other than to the extent of any pecuniary interest Mr. Orvis may have therein, directly or indirectly. The principal business address of this selling holder is c/o Sage Enterprises, LLC, 565 Hidden Hollow Ct., Bountiful, UT 84010. |

| (48) | Consists of 686,485 shares of Class A Common Stock issuable upon the exchange of Common Units and the surrender and cancellation of a corresponding number of shares of Class B Common Stock. Mr. Stark is an employee of the Company. |

| (166) | Consists of 1,330,000 shares of Class A Common Stock issuable upon the exchange of Common Units and the surrender and cancellation of a corresponding number of shares of Class B Common Stock. |

| (167) | Consists of 8,000 shares of Class A Common Stock issuable upon the exchange of Common Units and the surrender and cancellation of a corresponding number of shares of Class B Common Stock. |

Investing in our securities involves risks that are described in the section titled “Risk Factors” beginning on page 12 of the Prospectus.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December 30, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 30, 2022 ( December 29, 2022)

BRC Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-41275 | 87-3277812 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 1144 S. 500 W Salt Lake City, UT |

84101 | |||

| (Address of principal executive offices) | (Zip Code) |

(801) 874-1189

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbols |

Name of each exchange on which registered | ||

| Class A common stock, $0.0001 par value | BRCC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On December 29, 2022, Black Rifle Coffee Company LLC (the “Employer”), a subsidiary of BRC Inc. (the “Registrant”), entered into an Employment Agreement with (i) Evan Hafer, the Registrant’s Chief Executive Officer (the “Hafer Employment Agreement”) and (ii) a Severance and Restrictive Covenant Agreement with each of Gregory Iverson, the Registrant’s Chief Financial Officer, Toby Johnson, the Registrant’s Chief Operating Officer, and Andrew McCormick, the Registrant’s General Counsel and Secretary (collectively, the “Executive Severance Agreements”). The material terms of the Hafer Employment Agreement and the Executive Severance Agreements are described below.

Hafer Employment Agreement.

Pursuant to the Hafer Employment Agreement, Mr. Hafer will continue to serve as Chief Executive Officer and report to the Board of Directors of the Registrant. He will receive an annual base salary of at least $340,000 per year.

Under the Hafer Employment Agreement, in the event Mr. Hafer’s employment is terminated by the Employer without “cause” or Mr. Hafer resigns for “good reason” (each as defined in the Hafer Employment Agreement), subject to his execution of a release of claims, Mr. Hafer will be entitled to receive (a) a lump sum cash severance payment equal to three times his base salary and (b) reimbursement for the employer-portion of benefits coverage under COBRA for a period of 18 months’ following termination.

The Hafer Employment agreement also provides for noncompetion, nonsoliciation and other customary restrictive covenants that will apply during employment and for a period of three years thereafter.

Executive Severance and Restrictive Covenant Agreements.

The Executive Severance Agreements each generally provide for certain benefits to be payable to the individual in connection with a qualifying termination of employment, as well as certain restrictive covenants.

Each Executive Severance Agreement replaces any existing employment agreement to which the applicable executive is a party. Pursuant to the Executive Severance Agreements, if the applicable executive is terminated by the Employer without “cause” (as defined in the applicable Executive Severance Agreement), subject to execution of a release of claims, the executive would be entitled to receive an amount equal to (i) 12 months’ of base salary, payable in monthly installments over a one-year period following termination and (ii) reimbursement for the employer-portion of benefits coverage under COBRA for a period of 12 months following termination.

The Executive Severance Agreements also provide for noncompetition, nonsolicitation, noninterference and other customary restrictive covenants that apply during employment and for a fixed period thereafter (one year, in the case of the noncompetition covenants and two years, in the case of the nonsolicitation and noninterference covenants).

2

Founder Stock Award Grant

As contemplated in connection with the prior business combination of the Registrant with SilverBox Engaged Merger Corp I (the “Business Combination”), on December 29, 2022, the Registrant granted a Performance Stock Unit award (the “Founder Stock Award”) to Evan Hafer pursuant to its 2022 Omnibus Incentive Plan (the “Plan”) with respect to up to 8,462,412 shares of the Registrant’s Class A Common Stock (“Class A Shares”). As previously disclosed by the Registrant, and as described in greater detail below, the Founder Stock Award will vest in accordance with the terms of the Plan and the Founder Stock Award Agreement entered into on December 29, 2022, based upon the attainment of specified compound annual growth rate metrics relating to the Registrant’s implied market capitalization.

Below is a description of the material terms of the Founder Stock Award:

| · | Performance Period End Date: April 30, 2027. |

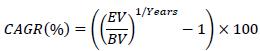

| · | Performance Criteria. Performance under the Founder Stock Award is measured based upon the compound annual growth rate (“CAGR”) of the Registrant’s implied market capitalization (determined as set forth in the Founder Stock Agreement) over a baseline of $1,831,161,970 (which is equal to the implied market capitalization of the Registrant following the closing of the Business Combination). The Founder Stock Award will generally vest based upon the Registrant’s attainment of CAGR targets through the end of the performance period, subject to Mr. Hafer’s continued employment through such date. Performance-based restricted stock units (“PSUs”) with respect to 4,231,206 Class A Shares (50% of the total Founder Stock Award) will vest in the event a CAGR of at least 25% is attained. In the event a CAGR of greater than 25% is attained, PSUs with respect to an additional number of Class A Shares will vest on a straight-line basis such that the full remaining amount of the Founder Stock Award would vest upon attainment of a CAGR of 50%. No PSUs will vest (other than any PSUs that have become Accumulated PSUs, as defined below) in the event the CAGR is below 25%. |

| Based upon the current aggregate number of outstanding Class A Shares and shares of Class B Common Stock, and subject to any PSUs that become Accumulated PSUs, as described below, the Founder Stock Award would require a minimum price per Class A Share of approximately $26.00 to vest in any respect and a price of approximately $65.00 per Class A Share to vest in full. However, the actual stock price required to attain performance-vesting will depend on the actual number of shares outstanding as of the applicable measurement date. |

| · | Annual Measurement. Under the Founder Stock Award, the CAGR will be measured each year, and in the event the CAGR targets are attained a pro-rata portion of such award will become performance-vested (“Accumulated PSUs”) and remain subject only to continued service-based vesting through the end of the performance period. |

| · | Termination of Employment. Under the Founder Stock Award, in the event Mr. Hafer’s employment is terminated by the Employer without “cause” or if he resigns for “good reason” (each as defined in the Hafer Employment Agreement) or Mr. Hafer’s employment terminates due to Mr. Hafer’s death or disability, he will (i) vest in PSUs that are Accumulated PSUs and (ii) forfeit all remaining PSUs. Upon termination of employment for any other reason, all unvested PSUs (including Accumulated PSUs) will be forfeited. |

| · | Change of Control. Upon a Change of Control (as defined in the Plan) unless otherwise assumed by any successor in a manner compliant with the Plan and the Founder Stock Award Agreement, the Founder Stock Award provides for payment on a pro-rata basis, based upon the CAGR attainment through the date of the Change of Control. |

The foregoing description of the applicable agreements does not purport to be complete and is qualified in its entirety by the full text of the Hafer Employment Agreement, which is filed herewith as Exhibit 10.1 and incorporated herein by reference, the Executive Severance Agreements, a form of which is filed herewith as Exhibit 10.2 and incorporated herein by reference, and the Founder Stock Award Agreement, which is filed herewith as Exhibit 10.3 and incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit | Description |

| 10.1 | Employment Agreement, dated as of December 29, 2022, by and between Evan Hafer and Black Rifle Coffee Company LLC. |

| 10.2 | Form of Severance and Restrictive Covenant Agreement. |

| 10.3 | Founder Stock Award Agreement, dated as of December 29, 2022, by and among BRC Inc. and Evan Hafer. |

| 104 | Cover Page Interactive Data File (embedded with the inline XBRL document) |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 30, 2022

| BRC INC. | ||

| By: | /s/ Tom Davin | |

| Name: | Tom Davin | |

| Title: | Co-Chief Executive Officer | |

4

EMPLOYMENT AGREEMENT

This Employment Agreement (the “Agreement”), dated as of December 29, 2022, is entered into by and between Black Rifle Coffee Company LLC, a Delaware limited liability company (the “Company”) and Evan Hafer (the “Executive”).

W I T N E S S E T H:

WHEREAS, Executive presently serves as Chief Executive Officer of the Company; and

WHEREAS, the Company and Executive wish to have Executive continue to serve as Chief Executive Officer on the terms set forth in this Agreement and to confirm the terms and conditions of such employment by entering into this Agreement.

NOW, THEREFORE, in consideration of the mutual covenants set forth in this Agreement, it is hereby agreed as follows:

1. Term of Employment. The term of Executive’s employment by the Company pursuant to this Agreement shall commence on the date hereof (the “Effective Date”) and shall continue until terminated in accordance with Section 4 hereof (such term, the “Term”).

2. Position, Duties and Location.

(a) Position and Duties. Other than as agreed by Executive, Executive shall serve as the Chief Executive Officer of the Company. During the Term, Executive shall have the duties and responsibilities that are commensurate with those previously held by Executive and those held by similarly situated executives at similarly situated companies of similar size, and such other duties and responsibilities assigned by the Board that are consistent with Executive’s position. Further, Executive shall continue to promote the Company and the Business (as defined below) in the public and on Social Media Channels consistent with Executive’s past practice. Executive shall report to the Board of Directors of BRC Inc. (the “Board”).

(b) Attention and Time. Executive shall devote substantially all his business attention and time to his duties hereunder and shall use his reasonable best efforts to carry out such duties faithfully and efficiently. During the Term, it shall not be a violation of this Agreement for Executive to (i) serve on industry, trade, civic or charitable boards or committees; (ii) conduct those activities set forth on Exhibit A; (iii) serve on up to two other non-competitive boards (as determined in the reasonable discretion of the Board) which have been approved by the Board, whose approval shall not unreasonably be withheld; (iv) deliver lectures or fulfill speaking engagements; or (v) manage personal investments; provided that all such activities in (i) though (v) of this section shall only be permitted as long as such activities do not materially interfere with the performance of Executive’s duties and responsibilities as described herein and do not otherwise breach the provisions of this Agreement.

(c) Location. Executive’s principal place of employment shall be located at the Company’s corporate office in San Antonio, Texas, but Executive shall be required to travel to and render services at other Company locations, as may reasonably be required by his duties hereunder.

3. Compensation.

(a) Base Salary. Executive shall receive a base salary (as applicable, the “Base Salary”) at an annual rate of no less than $340,000. Executive’s Base Salary shall be reviewed by the Company at least annually for increase, beginning on the first anniversary of the Effective Date. Base Salary shall be paid at such times and in such manner as the Company customarily pays the base salaries of its employees. In the event that Executive’s Base Salary is increased by the Board in its discretion at any time during the Term, such increased amount shall thereafter constitute the Base Salary.

(b) Other Compensation and Benefits. During the Term, Executive shall be entitled to participate in or receive benefits under any employee benefit programs of the Company (including life, health and disability programs) that are made available to executive officers of the Company to the extent that Executive complies with the conditions attendant with coverage under such plans or arrangements. Nothing contained herein shall be construed to prevent the Company from modifying or terminating any plan or arrangement.

(c) Vacation. Executive shall have a reasonably unlimited number of vacation days which may be taken subject to the business needs of the Company and the current work obligations of the Executive. Accordingly, Executive shall not accrue vacation days or be paid out for any unused vacation days.

(d) Expenses. During the Term, the Company shall promptly reimburse Executive in accordance with applicable Company policy for all reasonable expenses that Executive incurs during his employment with the Company in carrying out Executive’s duties under this Agreement.

(e) Additional Compensation and Benefits. Nothing contained in this Agreement shall limit the Board in awarding, in its discretion, additional compensation and benefits to Executive.

4. Termination of Employment. Executive’s employment shall terminate automatically upon his death or Disability. The Company may terminate Executive’s employment for Cause or without Cause. Executive may terminate his employment with or without Good Reason. Upon termination of Executive’s employment for any reason, the Company shall pay Executive within 10 business days of his Date of Termination (except with respect to reimbursements described in clause (C), which shall be paid within 20 business days of Executive’s Date of Termination) or, in each case, sooner as required by applicable law: (A) unpaid Base Salary through the Date of Termination, (B) any benefits due to Executive under any employee benefit plan of the Company under the terms and conditions of such plan, including insurance policies but excluding any severance program or policy and (C) any expenses owed to Executive, provided Executive properly submits documentation therefor in accordance with applicable Company policy within 10 business days after the Date of Termination ((A), (B), and (C) collectively, the “Accrued Amounts”).

2

(a) Death; Disability; Termination For Cause; Termination without Good Reason. Upon a termination of Executive’s employment (i) due to Executive’s death or Disability or (ii) by the Company for Cause or by Executive without Good Reason, Executive (or, in the case of Executive’s death, Executive’s estate and/or beneficiaries) shall be entitled to Executive’s Accrued Amounts. Except as set forth in this Section 4(a), Executive shall have no further right or entitlement under this Agreement to payments arising from termination of his employment due to death or Disability, by the Company for Cause or by Executive without Good Reason.

(b) Termination Without Cause or for Good Reason. In the event that, during the Term, the Company terminates Executive’s employment without Cause or Executive terminates his employment for Good Reason, Executive shall be entitled to the Accrued Amounts and, subject to Executive’s not breaching this Agreement, including Sections 5, 6 and 7, or any other post-employment obligations owed to the Company or its Affiliates, the following payments and benefits in lieu of any payments or benefits under any severance program or policy of the Company or its Affiliates:

(A) payment of an amount equal to Executive’s Base Salary (excluding any reductions thereto that serve as the basis for a termination for Good Reason) for the year of termination, multiplied by three (3), such amount to be paid in a lump sum as soon as practicable after the Date of Termination but no later than the earliest time permitted under Section 4(c) and Section 19; and

(B) at the Company’s election either (X) subject to Executive’s making a timely election pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”), continued health care coverage for a period ending on the earlier of eighteen months commencing on the Date of Termination or until Executive receives comparable coverage from a subsequent employer for Executive (and Executive’s eligible dependents, if any) under the Company’s health plans on the same basis as such coverage is made available to executives employed by the Company (including, without limitation, co-pays, deductibles and other required payments and limitations) with the Company paying the applicable COBRA premium in excess of the amount paid by active employees for such coverage or otherwise providing such coverage to Executive for the amount paid by active employees for such coverage and Executive’s qualifying event for purposes of COBRA shall be treated as occurring at the Date of Termination.

(c) Release. As a condition to receiving the payments and benefits set forth in Section 3(e) and 4(b), Executive shall be required, within sixty (60) days of Executive’s Date of Termination, to execute, deliver and not revoke (with any applicable revocation period having expired) a general release of claims substantially in a form attached hereto as Exhibit B, which may be modified for any adjustments required by any then-applicable law. Except to the extent otherwise required by Section 19, any payments or benefits that would otherwise have been made during such sixty (60)-day period shall not be made and shall be accumulated and paid in a single lump sum on the expiration of such sixty (60)-day period.

(d) Full Discharge. The amounts payable to Executive under this Section 4 following termination of Executive’s employment shall, once paid, be in full and complete satisfaction of Executive’s rights under this Agreement and any other claims he may have in respect of his employment by the Company or any of its Affiliates or subsidiaries, and Executive acknowledges that such amounts are fair and reasonable, and his sole and exclusive remedy, in lieu of all other remedies at law or in equity, with respect to the termination of his employment hereunder or breach of this Agreement. Nothing contained in this sub-section shall serve as a bar to any claim that would not have been released if Executive executed the release attached as Exhibit B upon Executive’s Date of Termination, whether or not such release is required to be executed in connection with such termination.

3

(e) Definitions. For purposes of this Agreement, the following definitions shall apply:

(i) “Affiliate” means a person or other entity that directly or indirectly controls, is controlled by, or is under common control with the Company.

(ii) “Business” means the business of sourcing, processing, manufacturing, packaging, distributing, marketing and selling any Covered Product and related merchandise and apparel, and designing, owning, operating, licensing and franchising coffee-based retail establishments, or any activities, services or products incidental or attendant thereto, including media enterprises based on persons associated with the Company or any of its Subsidiaries, Company values, and such business.

(iii) “Cause” means: (A) Executive’s continued failure (except where due to physical or mental incapacity) to substantially perform his duties as outlined in Section 2(a) of this Agreement after written notice from the Company requesting such performance and specifying Executive’s alleged failure; (B) Executive’s material malfeasance or gross neglect in the performance of his duties hereunder; (C) Executive’s conviction of, or plea of guilty or nolo contendere to, a misdemeanor involving moral turpitude as determined in the reasonable discretion of the Board or any felony; (D) the commission by Executive of an act of fraud or embezzlement against the Company or any Affiliate constituting a crime; (E) Executive’s material breach of any material provision of this Agreement that if capable of cure is not remedied within fifteen (15) days after (I) written notice from the Company specifying such breach and (II) the opportunity to appear before the Board; (F) Executive’s material violation of a written policy of the Company or its Affiliates that causes demonstrable damage to the Company; (G) Executive’s continued failure to cooperate in any audit or investigation involving the Company or its Affiliates or its or their financial statements or business practices that is not remedied within fifteen (15) days of written notice from the Company specifying such failure; or (H) Executive’s gross misconduct that adversely and materially affects the business or reputation of the Company and its Subsidiaries taken as a whole.

(iv) “Company Marks” means any Trademarks owned or controlled by the Company or its Affiliates.

(v) “Company Social Media Channel” means any Social Media Channel created by, or owned or controlled by, the Company or its Affiliates, or that includes all or any part of any Company Mark (provided such part of a Company Mark could reasonably be considered a trademark or an indicator of origin) in the username (or similar name or social media handle) or other identifying label or designation associated with such Social Medial Channel.

4

(vi) “Company Social Media Post” means any Social Media Post that (a) includes, contains, incorporates, or references any Company Mark, Company IP, any other Intellectual Property or Content owned or controlled by the Company or its Affiliates or (b) that a reasonable Person would associate with the Company, its Affiliates or the Business.

(vii) “Competing Business” means any business that competes with the Business or has taken material steps in preparation to compete with the Business (in each case, either directly or through its divisions, parents, subsidiaries or affiliates). For the avoidance of doubt, a company shall not be considered a Competing Business solely by reason of the sale of food or other merchandise unless such products are branded products and produced directly or indirectly by such company and identified with a proprietary brand of Covered Beverage, and unless either (i) the sales of proprietary-branded Covered Products or other related merchandise represents more than 15% of that company’s annual gross revenues or (ii) Executive’s role at such company relates primarily to such products.

(viii) “Content” means any work of authorship, content, or material, including written works of any kind or nature, photographs, images, negatives, films, outtakes, B-Roll, pictures, drawings, renderings, video recordings, audio recordings, audio-visual works, and digital images.

(ix) “Continuing Directors” means, as of any date of determination, any member of the Board (including Executive) who (i) was a member of the Board on the date of this Agreement or (ii) was nominated for election or elected to the Board with the approval of a majority of the Continuing Directors who were members of the Board at the time of such nomination or election.

(x) “Covered Product” means coffee (including in a beverage format, ground, whole bean, and “pod” formats) or any other beverage of the type the Company or its Subsidiaries, directly or indirectly, produce, distribute, sell or market or have taken material steps to do any of the foregoing.

(xi) “Date of Termination” / “Notice of Termination.” Any termination of Executive’s employment by the Company or by Executive under this Section 4 (other than termination due to death) shall be communicated by a written notice to the other party hereto indicating the specific termination provision in this Agreement relied upon, setting forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of Executive’s employment under the provision so indicated, and specifying a “Date of Termination” (a “Notice of Termination”) which, if submitted by Executive, shall be effective at least thirty (30) days following the date of such notice, which period may be waived by the Board. A Notice of Termination submitted by the Company may provide for a “Date of Termination” on the date Executive receives the Notice of Termination, or any date thereafter elected by the Company in its sole discretion not to exceed sixty (60) days following the date of such notice. The failure by Executive or the Company to set forth in the Notice of Termination any fact or circumstance which contributes to a showing of Cause or Good Reason shall not waive any right of Executive or the Company hereunder or preclude Executive or the Company thereafter from asserting such fact or circumstance within a period of six (6) months from the Date of Termination in order to enforce Executive’s or the Company’s otherwise applicable rights hereunder.

5

(xii) “Disability” shall mean Executive’s inability due to a mental or physical impairment to substantially perform his duties for the Company for ninety (90) consecutive days or one hundred and eighty (180) days in any two (2)-year period, as reasonably determined by the Board.

(xiii) “Executive Social Medial Channels” means any Social Media Channel owned or controlled by the Executive or an Executive’s immediate family member and that is not a Company Social Media Channel.

(xiv) “Good Reason” shall mean the occurrence, without Executive’s written consent, of: (A) a materially adverse change in Executive’s reporting obligations or, if applicable, the removal of Executive from all officer positions of the Company; (B) a materially adverse diminution in Executive’s employment duties, responsibilities or authority, or the assignment to Executive of duties that are materially and adversely inconsistent with his position; (C) any reduction in Base Salary other than any reduction of up to 20% that affects all officers of the Company; or (D) any material breach by the Company of this Agreement; provided, that any changes related to any transition among either or both of the CEO and Co-CEO shall not constitute Good Reason (including any transition by Executive from CEO to an alternative C-level title, such as Founder and Chief Marketing Officer), and provided, further that Executive may terminate his employment for Good Reason only if (I) within ninety (90) days of the date Executive has actual knowledge of the occurrence of an event of Good Reason, Executive provides written notice of the Company specifying such event, (II) the Company does not cure such event within ten (10) business days of such notice if the event is nonpayment of an amount due to Executive or within sixty (60) days of such notice for other events and (III) Executive actually terminates his employment within thirty (30) business days of the end of such cure period.

(xv) “Intellectual Property” means all intellectual property rights of any kind or nature, whether under statutory or common law, including (a) trademarks, service marks, domain names, trade dress, corporate names, brand names, trade names, and other indicia of source or origin, and all registrations, applications and renewals relating thereto or in connection therewith (including, in each case, the goodwill associated therewith) (“Trademarks”), (b) patents and patent applications, (c) copyrights, copyrightable works, and all applications and registrations therefor, (d) trade secrets, (e) rights in Content, Work Product, and Social Media Posts, and (f) all rights to sue for past, present, and future infringement, misappropriation or other violation of any of the foregoing.

(xvi) “Permitted Holders” shall mean each person or entity (and any affiliate of such person) beneficially owning more than ten percent (10%) of the Company’s voting stock on the Effective Date.

(xvii) “Prior Period” means any period during which (a) Executive was employed by the Company or any of its Affiliates or Subsidiaries (including any predecessors thereof) prior to the Effective Date or (b) Executive was engaged in work, activities, services, or efforts on behalf of the Company or the Business prior to the formation of the Company or any of its Subsidiaries or Affiliates (including any predecessors thereof).

6

(xviii) “Publicity Rights” means the name, voice, likeness, signature, photograph, video, biographical data, image, and other elements or attributes of an individual’s persona, identity, or personality, and any other rights of a similar nature protectable under applicable law.

(xix) “Social Media Channel” means any website, application, or other medium now known or hereafter devised that enables individuals to create or share Content or participate in social networking, including, but not limited to, YouTube, Facebook, Instagram, Twitter, TikTok, and Snapchat.

(xx) “Social Media Post” means the making available of Content on any Social Media Channel in any manner permitted by such Social Media Channel, regardless of the amount of time such Content is made available on the Social Media Channel.

(xxi) “Subsidiary” of the Company shall mean any corporation of which the Company owns, directly or indirectly, more than fifty percent (50%) of the voting stock.

(xxii) “Work Product” means all discoveries, developments, concepts, designs, ideas, know-how, modifications, improvements, derivative works, inventions, trade secrets, Trademarks, or Content, in each case whether or not patentable, copyrightable or otherwise legally protectable.

(f) Other Positions. Executive shall immediately resign, and shall be deemed to have immediately resigned without the requirement of any additional action, from any and all position Executive holds (including, if applicable, as a member of the Board) with the Company and its Affiliates on Executive’s Date of Termination. Executive shall cooperate with the Company and its Affiliates in taking any actions necessary to effectuate the foregoing.

(g) Breach of Payment Obligation. If the Company fails (other than pursuant to Section 18) to pay any amount due to Executive (or Executive’s estate) pursuant to this Section 4 as a result of Executive’s termination of employment within the fifteen (15) day period following written notice by Executive (it being understood and agreed that such notice may not be given until any such material payment has not been paid for at least fifteen (15) days following its scheduled payment date), the restrictions imposed by Section 7(a)(i) and (ii) shall immediately terminate.

5. Protection of Confidential Information.

(a) Non-Use and Non-Disclosure. Executive shall not, at any time during Executive’s employment with the Company or thereafter, or during the Prior Period, disclose or use any trade secret, proprietary or confidential information of the Company or any Subsidiary of the Company (collectively, “Confidential Information”) obtained or learned by Executive during the course of such employment or in any Prior Period, except for (i) disclosures and uses required in the course of such employment or with the prior written permission of the Company, (ii) disclosures with respect to any litigation, arbitration or mediation involving this Agreement, including but not limited to, the enforcement of Executive’s rights under this Agreement, or (iii) as may be required by law or by any court, arbitrator, mediator or administrative or legislative body (including any committee thereof) with apparent jurisdiction to order such disclosure; provided, that, if, in any circumstance described in clause (iii), Executive receives notice that any third party shall seek to compel such a disclosure of any Confidential Information, Executive shall promptly notify the Company and provide reasonable cooperation to the Company (at the Company’s sole expense) in seeking a protective order against such disclosure. Notwithstanding anything to the contrary in the foregoing, “Confidential Information” does not include information that is or becomes publicly known outside the Company or any of its subsidiaries other than due to a breach of Executive’s obligations under this paragraph.

7

(b) Return of Information. At the time of any termination of Executive’s employment with the Company, whether at the instance of Executive or the Company, and regardless of the reasons therefore, Executive shall (a) immediately cease any further use of Confidential Information and (b) deliver to the Company (at the Company’s expense), any and all notes, files, memoranda, papers and, in general, any and all physical (including electronic) matter containing Confidential Information that are in Executive’s possession or under Executive’s control, except as otherwise consented in writing by the Company at the time of such termination. The foregoing shall not prevent Executive from retaining copies of personal diaries, personal notes, personal address books, personal calendars, and any other personal information (including, without limitation, information relating to Executive’s compensation), but only to the extent such copies do not contain any Confidential Information other than that which relates directly to Executive, including his compensation.

(c) Defend Trade Secrets Act Notice. Notwithstanding the foregoing obligations of confidentiality, this Agreement does not affect any rights or immunities of Executive under 18 USC §1833(b)(1) or (2) and, as such, Executive shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that is made (a) in confidence to a federal, state, or local government official, or to an attorney, in each case solely for the purpose of reporting or investigating a suspected violation of law or (b) in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. If Executive files a lawsuit for retaliation by the Company or its Subsidiaries for reporting a suspected violation of law, then Executive may disclose the trade secret to Executive’s attorney and use the trade secret information in the court proceeding, if the Executive (or an attorney on Executive’s behalf) files any document containing the trade secret under seal; and does not disclose the trade secret, except pursuant to court order.

6. Intellectual Property.

(a) Ownership of Company IP. All Work Product created, invented, or developed by Executive, either during the Prior Period or during the Term, whether solely or jointly with others, and that (i) relates to the Business, (ii) is or was developed using any resources or equipment of or provided by the Company or its Affiliates, or (iii) is or was created within the scope of Executive’s employment by the Company, and all Intellectual Property in any of the foregoing, is the sole and exclusive property of the Company (collectively, the “Company IP”). Executive hereby acknowledges and agrees that the Company IP is intended to be a work made for hire under the U.S. Copyright Act of 1976, as amended, of which the Company is the owner. To the extent the Company IP is not, or is deemed not to be, a work made for hire, Executive hereby irrevocably assigns to the Company all of Executive’s right, title and interest in and to the Company IP, and Executive hereby waives all moral rights or other rights with respect to attribution of authorship or integrity related to any and all Company IP. Except as set forth in Section 6(c), Executive shall have no right to use any Company IP, including in connection with any digital assets (e.g., non-fungible tokens), without the prior written consent of Company.

8

(b) Executive IP. Executive represents and warrants that as of the Effective Date, there is no Work Product (or Intellectual Property therein) that: (i) has been created by or on behalf of Executive (either solely or jointly with others) or (ii) is owned exclusively by Executive or jointly by Executive with others and that both (x) relate to the Business and (y) are not assigned to the Company under this Agreement (“Executive IP”). Notwithstanding the foregoing, if the Executive uses with or incorporates into any Company IP or Company-Owned Social Media Post any Executive IP, or any other Intellectual Property that does not constitute Company IP, then Executive hereby grants to the Company a perpetual, irrevocable, nonexclusive, fully paid-up, royalty-free, sublicenseable (through multiple tiers), worldwide license under all such Intellectual Property to make, have made, use, sell, offer for sale, import, export, copy, publish, perform, make derivative works of, distribute, improve, modify, and otherwise exploit such Intellectual Property in connection with the Business (including any product or service thereof).

(c) Licenses to Executive.

(i) Subject to Section 6(c)(iii), the Company hereby grants to Executive a non-exclusive, non-transferable, non-sublicenseable, worldwide, royalty-free, fully paid-up license, solely during the Term, to use, copy, distribute, create derivative works of, perform, and display Content included in the Company IP or provided to Executive by the Company in connection with making Social Media Posts on the Executive Social Medial Channels.

(ii) Subject to Section 6(c)(iii) and 6(c)(iv), the Company hereby grants to Executive a non-exclusive, non-transferable, non-sublicenseable, worldwide, royalty-free, fully paid-up license, solely during the Term, to use the Company Marks in connection with making Social Media Posts on the Executive Social Media Channels. All goodwill arising from Executive’s use of the Company Marks will inure exclusively to the benefit of the Company.

(iii) The Company may, at any time and in its sole discretion, require Executive to modify or remove any Company Social Media Post from the Executive Social Media Channels, and Executive shall promptly (and in any event in no more than three business days) comply with such request.

(iv) Executive shall comply with all branding and quality guidelines and other instructions regarding the use of the Company Marks provided by the Company to Executive, and shall remove any Company Mark from a Social Media Post immediately upon the request of the Company.

9

(d) Licenses to the Company. Executive hereby grants to the Company an exclusive, worldwide, royalty-free, fully paid-up, sublicenseable (through multiple tiers), transferable, perpetual, irrevocable license to use, display, publish, copy, reproduce, distribute, and otherwise exploit in any form or media (whether now existing, known, or later developed) the Publicity Rights of Executive in connection with the conduct and promotion of the Business (including during the Prior Period), including all products and services of the Business. To the extent that Executive may not grant the foregoing license under applicable law, Executive hereby irrevocably releases, waives, acquits, and forever discharges the Company and its Affiliates and its and their past and present directors, officers, partners, agents, employees, successors, and assigns from any and all known or unknown claims, causes of action, or demands whatsoever in law or in equity that the Executive ever had, now has, or hereafter may acquire against any such parties based on, or arising out of, in whole or in part, the Company’s or its Affiliate’s use of any of the Executive’s Publicity Rights in connection with the conduct and promotion of the Business (including all products and services of the Business, and including during the Prior Period), and covenants not to use Executive’s Publicity Rights in connection with any Competing Business during the Term or thereafter. Notwithstanding anything to the contrary in the foregoing, nothing contained in this Agreement will require the Company to exercise or exploit any of its rights relating to Executive’s Publicity Rights.

(e) Social Medial Posts.

(i) Executive is the owner of all Executive Social Media Channels and the Social Media Posts made by or on behalf of Executive to an Executive Social Media Channel during the Prior Period or the Term to the extent that such Social Media Posts are unrelated to the Business and do not include, contain, incorporate, or reference any Company Mark, Company IP, or other Intellectual Property or Content owned or controlled by the Company (“Executive Social Media Posts”). For clarity, Executive Social Media Posts expressly exclude any Content that includes, contains, incorporates, or references Company Marks, Company IP, or other Intellectual Property or Content owned or controlled by the Company or its Affiliates, all of which are owned, as between the Executive and the Company, exclusively by the Company or its Affiliates.

(ii) The Company is the owner of all Social Media Posts made by or on behalf of Executive to a Social Media Channel (and all Content and Intellectual Property rights therein) to the extent such Social Media Post includes, contains, incorporates, or references any Company IP, any Company Marks, or any other Intellectual Property or Content owned or controlled by the Company or its Affiliates (collectively, the “Company-Owned Social Media Posts”). To the extent Executive has or obtains any rights in the Company-Owned Social Media Posts, Executive hereby assigns to the Company all of Executive’s right, title, and interest in and to such Company-Owned Social Media Posts.

(iii) Executive hereby grants to the Company a non-exclusive, worldwide, royalty-free, fully paid-up, sublicenseable (through multiple tiers), transferable, perpetual, irrevocable license to use, display, publish, copy, reproduce, distribute, and otherwise exploit in any form or media (whether now existing, known, or later developed) all Company Social Media Posts that do not constitute Company-Owned Social Media Posts (including in such license all rights to the Content and Intellectual Property therein).

10

(iv) The Company shall be responsible for ensuring that Content (including product statements) that Company provides Executive for inclusion in Social Media Posts made to an Executive Social Media Channel, and instructions that Company provides Executive with respect to making such Social Media Posts (if any), are compliant with applicable laws. Subject to the foregoing, Executive shall be responsible for ensuring that that all Company Social Media Posts made by or on behalf of Executive to any Social Media Channel are made in compliance with all applicable laws. Without limiting the foregoing, Executive shall comply with the FTC’s Enforcement Policy Statement on Deceptively Formatted Advertisements and the FTC’s Native Advertising: A Guide for Business, and any other applicable regulations, rules, or standards relating to the promotion of products or services on Social Media Channels, or that are otherwise applicable to the Company Social Media Posts on any Executive Social Media Channel, or that are otherwise made by or on behalf of Executive to any Social Media Channel. Promptly upon the request of the Company or the termination of this Agreement (but in no event more than five business days following either event), Executive shall deliver to the Company all tangible embodiments of Company-Owned Social Media Posts and Company Social Media Posts existing on any Executive Social Media Channel, or that have otherwise been made by or on behalf of Executive to any Social Media Channel (e.g., the underlying videos, photographs, and other Content, whether in digital or physical form). Upon the termination of this Agreement for any reason, Executive shall immediately cease making any Social Media Posts on any Social Media Channels, including Executive Social Media Channels, that would be a Company Social Media Post hereunder (except, and only to the extent, Executive and Company agree otherwise in writing).

(v) Immediately upon the termination of this Agreement by the Company for Cause, Executive shall remove all Company Social Media Posts from all Executive Social Media Channels, and shall cause the removal of all Company Social Media Posts made by or on behalf of Executive to any other Social Media Channel controlled by Executive or Executive’s immediate family members.

(f) Further Assurances. Executive shall assist the Company, or its designee, at Company’s expense, in every reasonable way in connection with securing the Company’s rights in the Company IP and the Company-Owned Social Media Posts, including executing or causing to be executed all documents reasonably requested by the Company. Executive hereby irrevocably designates and appoints the Company and its duly authorized officers and agents as Executive’s agent and attorney-in-fact, which is a right coupled with an interest, to act for and in Executive’s behalf and stead to execute and file any such instruments and papers and to do all other lawfully permitted acts to further the application for, prosecution, issuance, maintenance or transfer of any Company IP or Company-Owned Social Media Posts.

11

7. Noncompetition, Noninterference, Nondisparagement and Cooperation.

(a) General. Executive agrees that Executive shall not, other than in carrying out his duties hereunder, directly or indirectly, do any of the following: (i) during Executive’s employment with the Company and its Subsidiaries and for a period of three (3) years after any termination of such employment, render services in any capacity (including as an employee, director, member, consultant, partner, investor or independent contractor) to a Competing Business, (ii) during Executive’s employment with the Company and its Subsidiaries and for a period of three (3) years after any termination of such employment, attempt to, or assist any other person in attempting to, employ, engage, retain or partner with, any person who is then, or at any time during the ninety (90) day-period prior thereto was, a director, officer or other executive of the Company or a Subsidiary, or encourage any such person or any consultant, agent or independent contractor of the Company or any Subsidiary to terminate or adversely alter or modify such relationship with the Company or any Subsidiary; provided, that this section (ii) shall not be violated by general advertising, general internet postings or other general solicitation in the ordinary course not specifically targeted at such persons, or (iii) during Executive’s employment with the Company and its Subsidiaries and for a period of two (2) years after any termination of employment, solicit any then current customer or business partner of the Company or any Subsidiary to terminate, alter or modify its relationship with the Company or the Subsidiary or to interfere with the Company’s or any Subsidiary’s relationships with any of its customers or business partners. During and after the Term, Executive shall not make any public statement that is intended to or would reasonably be expected to disparage the Company, its Affiliates or its or their directors, officers, employees, the Business or products other than as required in the good faith discharge of his duties hereunder. During the Term and for three (3) years thereafter, the Company (including directors and officers of the Company in their capacity as such) agrees that it shall not make any public statement that is intended to or would reasonably be expected to disparage Executive. At the request of Executive, the Company shall direct its then-current directors and officers to not make any statements that would violate this Section 7(a) if they were made by the Company. Notwithstanding the foregoing, nothing in this Section 7(a) shall prevent any person from (A) responding publicly to any incorrect, disparaging or derogatory public statement made by or on behalf of the other party to the extent reasonably necessary to correct or refute such public statement or (B) making any truthful statement to the extent required by law. Nothing in this Agreement is intended to or will be used in any way to limit Executive’s rights to communicate with a government agency, as provided for, protected under or warranted by applicable law. Nothing contained herein shall prevent Executive from acquiring, solely as an investment, any publicly-traded securities of any person so long as he remains a passive investor in such person and does not own more than one percent (1%) of the outstanding securities thereof.

(b) Cooperation. Executive agrees to reasonably cooperate with the Company and its attorneys, both during and after the termination of Executive’s employment, in connection with any litigation or other internal or external proceeding arising out of or relating to matters in which Executive was involved prior to the termination of Executive’s employment so long as such cooperation does not materially interfere with Executive’s employment or consulting. In the event that such cooperation is required after the termination of Executive’s employment with the Company and its Subsidiaries, the Company shall pay Executive at the rate of $170 per hour and out-of-pocket expenses approved in advance by the Company after presentation by Executive of reasonable documentation related thereto.

12

8. Enforcement. Executive acknowledges and agrees that: (i) the purpose of the covenants set forth in Sections 5 through 7 above (the “Restrictive Covenants”) is to protect the goodwill, trade secrets and other confidential information of the Company; (ii) because of the nature of the business in which the Company is engaged and because of the nature of the Confidential Information to which Executive has access, it would be impractical and excessively difficult to determine the actual damages of the Company in the event Executive breached any such covenants; and (iii) remedies at law (such as monetary damages) for any breach of Executive’s obligations under the Restrictive Covenants would be inadequate. Executive therefore agrees and consents that if Executive commits any breach of a Restrictive Covenant, the Company shall have the right (in addition to, and not in lieu of, any other right or remedy that may be available to it) to temporary and permanent injunctive relief from a court of competent jurisdiction, without posting any bond or other security and without the necessity of proof of actual damage. If any portion of the Restrictive Covenants is hereafter determined to be invalid or unenforceable in any respect, such determination shall not affect the remainder thereof, which shall be given the maximum effect possible and shall be fully enforced, without regard to the invalid portions. In particular, without limiting the generality of the foregoing, if the covenants set forth in Section 7 are found by a court or an arbitrator to be unreasonable, Executive and the Company agree that the maximum period, scope or geographical area that is found to be reasonable shall be substituted for the stated period, scope or area, and that the court or arbitrator shall revise the restrictions contained herein to cover the maximum period, scope and area permitted by law. If any of the Restrictive Covenants are determined to be wholly or partially unenforceable in any jurisdiction, such determination shall not be a bar to or in any way diminish the Company’s right to enforce any such covenant in any other jurisdiction.

9. Indemnification.

(a) The Company agrees that if Executive is made a party to, is threatened to be made a party to, receives any legal process in, or receives any discovery request or request for information in connection with, any action, suit or proceeding, whether civil, criminal, administrative or investigative, excluding any action instituted by Executive, any action related to any actual violation of Section 16 of the Exchange Act by Executive or any action brought by the Company for compensation or damages related to Executive’s breach of this Agreement (a “Proceeding”), by reason of the fact that he was a director, officer, employee, consultant or agent of the Company, or was serving at the request of, or on behalf of, the Company as a director, officer, member, employee, consultant or agent of another corporation, limited liability corporation, partnership, joint venture, trust or other entity, including service with respect to employee benefit plans, whether or not the basis of such Proceeding is Executive’s alleged action in an official capacity while serving as a director, officer, member, employee, consultant or agent of the Company or other entity, Executive shall be indemnified and held harmless by the Company to the fullest extent permitted or authorized by the Company’s certificate of incorporation or by-laws or, if greater, by applicable law, against any and all costs, expenses, liabilities and losses (including, without limitation, attorneys’ fees reasonably incurred, judgments, fines, taxes or penalties and amounts paid or to be paid in settlement and any reasonable cost and fees incurred in enforcing his rights to indemnification or contribution) incurred or suffered by Executive in connection therewith, and such indemnification shall continue as to Executive even though he has ceased to be a director, officer, member, employee, consultant or agent of the Company or other entity and shall inure to the benefit of Executive’s heirs, executors and administrators. The Company shall reimburse Executive for all costs and expenses (including, without limitation, reasonable attorneys’ fees) incurred by him in connection with any Proceeding within twenty (20) business days after receipt by the Company of a written request for such reimbursement and appropriate documentation associated with these expenses. Such request shall include an undertaking by Executive to repay the amount of such advance if it shall ultimately be determined that he is not entitled to be indemnified against such costs and expenses; provided, that the amount of such obligation to repay shall be limited to the after-tax amount of any such advance except to the extent Executive is able to offset such taxes incurred on the advance by the tax benefit, if any, attributable to a deduction for repayment.

13

(b) Neither the failure of the Company (including the Board or the Company’s independent legal counsel or stockholders) to have made a determination prior to the commencement of any proceeding concerning payment of amounts claimed by Executive under Section 9(a) above that indemnification of Executive is proper because he has met the applicable standard of conduct, nor a determination by the Company (including the Board or the Company’s independent legal counsel or stockholders) that Executive has not met such applicable standard of conduct, shall create a presumption or inference that Executive has not met the applicable standard of conduct.

(c) The Company agrees to continue and maintain a directors’ and officers’ liability insurance policy covering Executive at a level, and on terms and conditions, no less favorable to him than the coverage the Company provides other similarly-situated executives for six (6) years after Executive’s Date of Termination or such longer statute of limitation period.

(d) Nothing in this Section 9 shall be construed as reducing or waiving any right to indemnification, or advancement of expenses, Executive would otherwise have under any other agreement with the Company (including, but not limited to, any executed indemnification agreements between Executive and the Company), the Company’s certificate of incorporation or by-laws or under applicable law.

10. Arbitration. Subject to Section 8, in the event that any dispute arises between the Company and Executive regarding or relating to this Agreement and/or any aspect of Executive’s employment relationship with the Company, the parties consent to resolve such dispute through mandatory arbitration under the Commercial Rules of the American Arbitration Association (“AAA”), before a panel of three (3) arbitrators in Salt Lake City, Utah. The parties hereby consent to the entry of judgment upon award rendered by the arbitrator in any court of competent jurisdiction. Notwithstanding the foregoing, should adequate grounds exist for seeking immediate injunctive or immediate equitable relief, any party may seek and obtain such relief. The parties hereby consent to the exclusive jurisdiction of the state and Federal courts of or in the State of Utah for purposes of seeking such injunctive or equitable relief as set forth above. Out-of-pocket costs and expense reasonably incurred by Executive in connection with such arbitration (including attorneys’ fees) shall be paid by the Company with respect to each claim on which the arbitrator determines Executive prevails.

11. Mutual Representations.

(a) Executive acknowledges that before signing this Agreement, Executive was given the opportunity to read it, evaluate it and discuss it with Executive’s personal advisors. Executive further acknowledges that the Company and its advisors have not provided Executive with any legal or tax advice regarding this Agreement.

14

(b) Executive represents and warrants to the Company that the execution and delivery of this Agreement and the fulfillment of the terms hereof (i) shall not constitute a violation, default under, or conflict with, any agreement or other instrument to which he is a party or by which he is bound or any other legal obligation and (ii) as to his execution and delivery of this Agreement do not require the consent of any other person.

(c) The Company represents and warrants to Executive that (i) the execution, delivery and performance of this Agreement by the Company has been fully and validly authorized by all necessary corporate action, (ii) the person signing this Agreement on behalf of the Company is duly authorized to do so, (iii) the execution, delivery and performance of this Agreement does not violate any applicable law, regulation, order, judgment or decree or any agreement, plan or corporate governance document to which the Company is a party or by which it is bound and (iv) upon execution and delivery of this Agreement by the parties, it shall be a valid and binding obligation of the Company enforceable against it in accordance with its terms, except to the extent that enforceability may be limited by applicable bankruptcy, insolvency or similar laws affecting the enforcement of creditors’ rights generally.

(d) Each party hereto represents and warrants to the other that this Agreement constitutes the valid and binding obligations of such party enforceable against such party in accordance with its terms.

12. Notices. All notices and other communications required or permitted hereunder shall be in writing and shall be deemed given when delivered (i) personally, (ii) by registered or certified mail, postage prepaid with return receipt requested, (iii) by facsimile with evidence of completed transmission, or (iv) by overnight courier to the party concerned at the address indicated below or to such changed address as such party may subsequently give such notice of:

| If to the Company: | Black Rifle Coffee Company LLC 1144 500 West Salt Lake City, UT 84101 Phone: (844) 899-9330 Attention: General Counsel |

| If to Executive: | [At the address on file with the Company] |

13. Assignment and Successors. This Agreement is personal in its nature and none of the parties hereto shall, without the consent of the others, assign or transfer this Agreement or any rights or obligations hereunder; provided, however, that in the event of any merger, consolidation, or transfer or sale of all or substantially all of the assets of the Company with or to any other individual(s) or entity, this Agreement shall, subject to the provisions hereof, be binding upon and inure to the benefit of such successor, and such successor shall discharge and perform all the promises, covenants, duties, and obligations of the Company hereunder, and such transferee or successor shall be required to assume such obligations by contract (unless such assumption occurs by operation of law). Anything herein to the contrary notwithstanding, Executive shall be entitled to select (and change, to the extent permitted under any applicable law) a beneficiary or beneficiaries to receive any compensation or benefit payable hereunder following Executive’s death or judicially determined incompetence by giving the Company written notice thereof. In the event of Executive’s death or a judicial determination of his incompetence, reference in this Agreement to Executive shall be deemed, where appropriate, to refer to his beneficiary, estate or other legal representative.

15

14. Governing Law; Amendment. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware, without reference to principles of conflict of laws. This Agreement may not be amended or modified except by a written agreement executed by Executive and the Company or their respective successors and legal representatives.

15. Severability. The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement. If any provision of this Agreement shall be held invalid or unenforceable in part, the remaining portion of such provision, together with all other provisions of this Agreement, shall remain valid and enforceable and continue in full force and effect to the fullest extent consistent with law.

16. Tax Withholding. Notwithstanding any other provision of this Agreement, the Company may withhold from amounts payable under this Agreement all federal, state, local and foreign taxes that are required to be withheld by applicable laws or regulations.

17. No Waiver. Executive’s or the Company’s failure to insist upon strict compliance with any provision of, or to assert any right under, this Agreement shall not be deemed to be a waiver of such provision or right or of any other provision of or right under this Agreement. Any provision of this Agreement may be waived by the parties hereto; provided, that any waiver by any person of any provision of this Agreement shall be effective only if in writing and signed by each party and such waiver must specifically refer to this Agreement and to the terms or provisions being modified or waived.

18. No Mitigation. In no event shall Executive be obligated to seek other employment or take other action by way of mitigation of the amounts payable to Executive under any of the provisions of this Agreement and, except as set forth herein, such amounts shall not be subject to offset or otherwise reduced whether or not Executive obtains other employment. The Company’s obligation to make any payment pursuant to, and otherwise to perform its obligations under, this Agreement shall not be affected by any offset, counterclaim or other right that the Company have against Executive for any reason; provided, that the Company may cease making the payments or providing the benefits, in each case, under Section 4 if Executive materially breaches the provisions of this Agreement and, if curable, does not cure such breach within fifteen (15) days after written notice from the Company.

16

19. Section 409A. This Agreement is intended to satisfy the requirements of Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”) with respect to amounts, if any, subject thereto and shall be interpreted and construed and shall be performed by the parties consistent with such intent. To the extent Executive would otherwise be entitled to any payment under this Agreement, or any plan or arrangement of the Company or its Affiliates, that constitutes a “deferral of compensation” subject to Section 409A and that if paid during the six (6) months beginning on the Date of Termination of Executive’s employment would be subject to the Section 409A additional tax because Executive is a “specified employee” (within the meaning of Section 409A and as determined by the Company), the payment will be paid to Executive on the earlier of the six (6) month anniversary of his Date of Termination or death. To the extent Executive would otherwise be entitled to any benefit (other than a payment) during the six (6) months beginning on termination of Executive’s employment that would be subject to the Section 409A additional tax, the benefit will be delayed and will begin being provided on the earlier of the first day following the six (6) month anniversary of Executive’s Date of Termination or death. Any payment or benefit due upon a termination of employment that represents a “deferral of compensation” within the meaning of Section 409A shall be paid or provided only upon a “separation from service” as defined in Treasury Regulation § 1.409A-1(h). Each payment made under this Agreement shall be deemed to be a separate payment for purposes of Section 409A. Amounts payable under this Agreement shall be deemed not to be a “deferral of compensation” subject to Section 409A to the extent provided in the exceptions in Treasury Regulation §§ 1.409A-1(b)(4) (“Short-Term Deferrals”) and (b)(9) (“Separation Pay Plans,” including the exception under subparagraph (iii)) and other applicable provisions of Treasury Regulation § 1.409A-1 through A-6. Notwithstanding anything to the contrary in this Agreement or elsewhere, any payment or benefit under this Agreement or otherwise that is exempt from Section 409A pursuant to Treasury Regulation § 1.409A-1(b)(9)(v)(A) or (C) (relating to certain reimbursements and in-kind benefits) shall be paid or provided only to the extent that the expenses are not incurred, or the benefits are not provided, beyond the last day of the second calendar year following the calendar year in which Executive’s “separation from service” occurs; and provided, further, that such expenses are reimbursed no later than the last day of the third calendar year following the calendar year in which Executive’s “separation from service” occurs. To the extent any expense reimbursement (including, without limitation, any reimbursement of interest or penalties related to taxes) or the provision of any in-kind benefit is determined to be subject to Section 409A (and not exempt pursuant to the prior sentence or otherwise), the amount of any such expenses eligible for reimbursement, or the provision of any in-kind benefit, in one calendar year shall not affect the expenses eligible for reimbursement in any other calendar year (except for any life-time or other aggregate limitation applicable to medical expenses), in no event shall any expenses be reimbursed after the last day of the calendar year following the calendar year in which Executive incurred such expenses, and in no event shall any right to reimbursement or the provision of any in-kind benefit be subject to liquidation or exchange for another benefit.

20. Headings. The Section headings contained in this Agreement are for convenience only and in no manner shall be construed as part of this Agreement.

21. Entire Agreement. This Agreement, together with the exhibits hereto, constitutes the entire agreement of the parties with respect to the subject matter hereof and shall supersede all prior agreements, whether written or oral, with respect thereto. In the event of any inconsistency between the terms of this Agreement and the terms of any other Company plan, policy, equity grant, arrangement or agreement with Executive, the terms of this Agreement shall govern, provided that the Executive shall be entitled to the benefit of any indemnification agreement that is more favorable to the Executive than this Agreement, provided further that the Executive shall be liable to comply with the terms of any post-employment restrictive covenant obligation that is not as favorable to the Executive as this Agreement.

22. Survival. The respective rights and obligations of the parties hereunder shall survive any termination of Executive’s employment to the extent necessary to give effect to such rights and obligations as set forth herein. Without limiting the foregoing, Sections 5 through 24 (except for Section 6(c)) will all survive any termination of Executive’s employment of this Agreement or the Term.

17

23. Counterparts. This Agreement may be executed simultaneously in two or more counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument.

24. Certain Change in Control Payments. Notwithstanding any provision of this Agreement to the contrary, if any payments or benefits Executive would receive from the Company under this Agreement or otherwise (the “Total Payments”) (a) constitute “parachute payments” within the meaning of Section 280G of the Code, and (b) but for this Section 24, would be subject to the excise tax imposed by Section 4999 of the Code, then Executive will be entitled to receive either (i) the full amount of the Total Payments or (ii) a portion of the Total Payments having a value equal to $1 less than three (3) times such individual’s “base amount” (as such term is defined in Section 280G(b)(3)(A) of the Code), whichever of (i) and (ii), after taking into account applicable federal, state, and local income taxes and the excise tax imposed by Section 4999 of the Code, results in the receipt by such employee on an after-tax basis, of the greatest portion of the Total Payments. Any determination required under this Section 24 shall be made in writing by the accountant or tax counsel selected by the Company. If there is a reduction pursuant to this Section 24 of the Total Payments to be delivered to Executive and to the extent that an ordering of the reduction other than by Executive is required by Section 19 or other tax requirements, the payment reduction contemplated by the preceding sentence shall be implemented by determining the “Parachute Payment Ratio” (as defined below) for each “parachute payment” and then reducing the “parachute payments” in order beginning with the “parachute payment” with the highest Parachute Payment Ratio. For “parachute payments” with the same Parachute Payment Ratio, such “parachute payments” shall be reduced based on the time of payment of such “parachute payments,” with amounts having later payment dates being reduced first. For “parachute payments” with the same Parachute Payment Ratio and the same time of payment, such “parachute payments” shall be reduced on a pro rata basis (but not below zero) prior to reducing “parachute payments” with a lower Parachute Payment Ratio. For purposes hereof, the term “Parachute Payment Ratio” shall mean a fraction the numerator of which is the value of the applicable “parachute payment” for purposes of Section 280G of the Code and the denominator of which is the actual present value of such payment.

[Signature page follows]

18

IN WITNESS WHEREOF, Executive and the Company have caused this Agreement to be executed as of the date first above written.

| BLACK RIFLE COFFEE COMPANY LLC | ||

| By: | /s/ Tom Davin | |

| Name: | Tom Davin | |

| Title: | Co-Chief Executive Officer | |

| EXECUTIVE | |

| /s/ Evan Hafer | |

| Evan Hafer |

[Signature Page to Employment Agreement]

Exhibit A

Passive ownership of an equity interest in Idaho River Adventures, as previously disclosed to the Board.

Exhibit B

Agreement and General Release

Agreement and General Release (“Agreement”), by and between Evan Hafer (“Executive” and referred to herein as “you”) and Black Rifle Coffee Company LLC (the “Company”).

1. In exchange for your waiver of claims against the Released Persons (as defined below) and compliance with the other terms and conditions of this Agreement, upon the effectiveness of this Agreement, the Company agrees to provide you with the payments and benefits provided in Section 4 of your employment agreement with the Company, dated [DATE] (the “Employment Agreement”) in accordance with the terms and conditions of the Employment Agreement.