Wednesday, May 28, 2025 at 11:00 a.m. Eastern Time | |||

Online at: www.virtualshareholdermeeting.com/BRCC2025 | |||

| BRC Inc. 1144 S. 500 W Salt Lake City, UT 84101 | ||

April 15, 2025 |

| BRC Inc. 1144 S. 500 W Salt Lake City, UT 84101 |

| to elect as directors the nominees named in the accompanying Proxy Statement to a term of three years, or until their respective successors have been elected and qualified; | |||

| to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025; and | |||

| to transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. | |||

• | Total revenue was $391.5 million in 2024, with Wholesale channel revenue increasing by 9% year-over-year, driven by continued growth in packaged coffee sales and the launch of Black Rifle Energy. DTC channel revenue decreased by 14% to $123.8 million in 2024, primarily due to lower customer acquisition rates, shifts in consumer purchasing behavior toward retail channels, and strategic reallocation of marketing spend toward higher return areas. | |||

• | According to Nielsen, in 2024 we expanded our packaged coffee distribution by 11 points, reaching 48.6% of retailers selling similar products, up from 37.1% in 2023. Our Ready-to-Drink coffee distribution grew by 3.8 points, reaching 47.2% of comparable retailers. Additionally, Black Rifle Energy, launched in late 2024, achieved distribution in 20% of relevant retailers within just three months of its introduction. | |||

• | In one year, we built a $100 million business with the largest nationwide retailer and have sustained that level of revenue since reaching that milestone. Our share of the coffee aisle remains consistent at the largest nationwide retailer; we are the #4 brand in bagged coffee by sales and are #1 for brand loyalty in the coffee category. | |||

• | Gross margin expanded by 950 basis points to 41.2% in 2024, primarily driven by improved supply chain productivity and favorable year-over-year comparisons as we cycled past ready-to-drink transformation costs. Total operating expenses declined by 10% in 2024 compared to the prior year, reflecting cost savings from restructuring initiatives that streamlined our corporate infrastructure. Net cash provided by operating activities was $11.3 million in 2024, an improvement of $36.3 million compared to the previous year. | |||

• | Approximately 32% of our employees are Veterans or military spouses, underscoring our ongoing commitment to hiring and supporting the military and first responder communities, along with continued meaningful donations through cash and product contributions. | |||

BRC Inc. | 1 | 2025 Proxy Statement |

Board Vote Recommendation | Proposals | Page | ||||||||

FOR the nominees |  | Elect three Class III Directors | ||||||||

FOR |  | Ratify appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2025 | ||||||||

BRC Inc. | 2 | 2025 Proxy Statement |

• | Creating meaningful post-military service career opportunities for Veterans, first responders, and their families; |

• | Donating cash, coffee and in-kind resources to charities that support the needs of active military, Veterans, and first responders; |

• | Supporting charities focusing on mental health issues in the Veteran community; |

• | Inspiring Veterans to pursue entrepreneurship through targeted programs and donations; and |

• | Providing quality products and media that resonate with these audiences. |

BRC Inc. | 3 | 2025 Proxy Statement |

• | Mental Health & PTSD Treatment – Providing funding for essential treatment programs, including our commitment to the Boot Campaign. |

• | Career Transition – Supporting Veterans’ transition into meaningful careers through partnerships with organizations like The Honor Foundation and Warrior Rising. |

• | Suicide Prevention – Backing initiatives that offer direct mental health interventions and suicide prevention programs. |

• | Food Insecurity – Partnering with organizations like Operation Homefront to provide meals for struggling military families. |

• | Homelessness Prevention – Supporting organizations that offer housing solutions and emergency relief for Veterans in need. |

BRC Inc. | 4 | 2025 Proxy Statement |

BRC Inc. | 5 | 2025 Proxy Statement |

BRC Inc. | 6 | 2025 Proxy Statement |

over the Internet |  by Telephone |  by Mail |  electronically at the Annual Meeting | |||||||

You can vote over the Internet at www.proxyvote.com by following the instructions on the Internet Notice or proxy card; | You can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card; | You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail; or | If you attend the meeting online, you will need the 16-digit control number included in your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials to vote electronically during the Annual Meeting. | |||||||

BRC Inc. | 7 | 2025 Proxy Statement |

BRC Inc. | 8 | 2025 Proxy Statement |

BRC Inc. | 9 | 2025 Proxy Statement |

BRC Inc. | 10 | 2025 Proxy Statement |

• | Ethics. The nominating and corporate governance committee seeks director nominees who are persons of good reputation and character who conduct themselves in accordance with high personal and professional ethical standards, including the policies set forth in the Company’s Code of Ethics. |

• | Conflicts of Interest. Each director or director nominee should not, by reason of any other position, activity or relationship, be subject to any conflict of interest that would impair the director or director nominee’s ability to fulfill the responsibilities of a member of the Board. |

• | Independence. The nominating and corporate governance committee will consider whether directors and director nominees will be considered independent under the standards of the New York Stock Exchange (“NYSE”), and the heightened independence standards for audit committees and compensation committee under the securities laws. |

• | Business and Professional Activities. Directors and director nominees should maintain a professional life active enough to keep them in contact with the markets and/or the industry in which the Company is active. A significant position or title change will be seen as reason to review a director’s membership on the Board. |

• | Experience, Qualifications and Skills. Directors and director nominees should have the educational background, experience, qualifications and skills relevant for effective management and oversight of the Company’s management, which may include experience at senior executive levels in comparable companies, public service, professional service firms, or educational institutions. |

• | Time/Participation. Directors and director nominees should have the time and willingness to carry out their duties and responsibilities effectively, including time to study informational and background materials and to prepare for meetings. Directors should attempt to arrange their schedules to allow them to attend all scheduled Board and committee meetings. The Board will consider the participation of and contributions to the activities of the Board for any director recommended for re-nomination. |

• | Board Evaluation. The nominating and corporate governance committee will consider the results of the annual Board evaluation in its Board refreshment strategy. |

• | Overboarding. No director or director nominee may serve on more than four public company boards (including the Company’s Board). No director or director nominee that is an executive officer of a public company may serve on more than two public company boards (including the Company’s Board). No member of the audit committee may serve simultaneously on the audit committee of more than three public companies (including the Company’s audit committee). Accepting a directorship with another public company that the director did not hold when elected or appointed to the Board will be seen as a reason to review a director’s membership on the Board. |

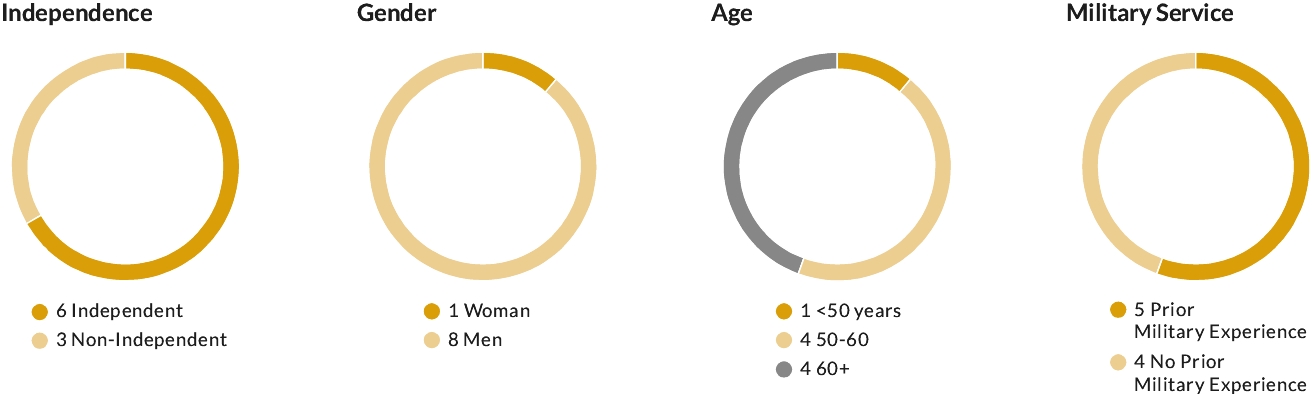

• | Diversity. The Board and nominating and corporate governance committee believe that diversity, including gender, race, ethnicity and United States military service, brings a diversity of viewpoints to the Board that is important to the effectiveness of the Board’s oversight of the Company. |

• | Tenure/Retirement. The Board and nominating and corporate governance committee do not believe that there should be a fixed term or retirement age for directors, but will consider each director’s tenure and the average tenure of the Board. |

BRC Inc. | 11 | 2025 Proxy Statement |

BRC Inc. | 12 | 2025 Proxy Statement |

Director | Corporate Governance | Finance & Capital Markets | Mergers & Acquisitions | Marketing | Diversity | Consumer Packaged Goods | Technology | Growth Company | Military and/or Government Service | ||||||||||||||||||||

Chris Mondzelewski | • | | • | • | | • | • | • | |||||||||||||||||||||

Lawrence Molloy | • | • | • | • | | • | | • | • | ||||||||||||||||||||

Kathryn Dickson | • | | | • | • | • | • | • | |||||||||||||||||||||

Clayton Hutmacher | • | | | | | | • | ||||||||||||||||||||||

Evan Hafer | • | | | • | • | • | • | ||||||||||||||||||||||

Steven Taslitz | • | • | • | • | | • | • | • | |||||||||||||||||||||

Glenn Welling | • | • | • | | | • | • | | |||||||||||||||||||||

Stephen Kadenacy | • | • | • | • | • | ||||||||||||||||||||||||

Sean Moriarty | • | • | • | • | • | ||||||||||||||||||||||||

BRC Inc. | 13 | 2025 Proxy Statement |

Evan Hafer Age 48 Director Since October 2014 Committee Service: • Nominating and Corporate Governance Committee (Chair) | Evan Hafer founded the Company in 2014 and was Chief Executive Officer since its inception through the end of December 2023, when he transitioned to the position of Founder and Executive Chairman. He has served as a director since the Company was founded and previously served as Chairman of the Board from October 2014 to July 2022. Prior to founding the Company, Mr. Hafer had fifteen years of service in the U.S. military and worked as a contractor for the CIA. As a member of the military, he served as a Green Beret with the 19th Special Forces Group and was deployed overseas multiple times. Mr. Hafer attended the University of Idaho and has been roasting coffee since 2006. | ||

MR. HAFER IS QUALIFIED TO SERVE ON OUR BOARD BASED ON HIS ROLE AND EXPERIENCE AS FOUNDER, AND PREVIOUSLY CHIEF EXECUTIVE OFFICER, OF THE COMPANY. | |||

Steven Taslitz Independent Age 66 Director Since December 2017 Committee Service: • Audit Committee • Nominating and Corporate Governance Committee | Steven Taslitz is a director on our Board and currently serves as a member of the nominating and corporate governance committee and the audit committee. Mr. Taslitz is also currently on the board of directors of Datacubed Health, Stella, Fancy Sprinkles and Mellomanic. He co-founded Sterling Partners in 1983 and is Chairman of the firm. Sterling Partners has invested in and owned upwards of 100+ companies over time, many of which Mr. Taslitz has served on the Board of Directors and also on their audit committees. Mr. Taslitz has supported and served on a number of educational, non-profit boards, including the Illinois Board of Higher Education, the Glencoe Educational Foundation, and the Investment Committee of the Jewish United Fund. He received a BS in Accountancy with Honors from the University of Illinois. | ||

MR. TASLITZ IS QUALIFIED TO SERVE ON OUR BOARD BASED ON HIS KNOWLEDGE OF OUR BUSINESS AND HIS EXTENSIVE EXPERIENCE AS A DIRECTOR OF A DIVERSE RANGE OF COMPANIES. | |||

BRC Inc. | 14 | 2025 Proxy Statement |

Glenn Welling Independent Age 54 Director Since February 2022 Committee Service: • Audit Committee • Compensation Committee | Glenn Welling is a director on our Board and currently serves as a member of the audit committee and the compensation committee. Mr. Welling is the founder and CIO of Engaged Capital, a constructive activist fund that invests in small and mid-cap public companies, a position that he has held since 2012. Previously, Mr. Welling was a Principal and Managing Director at Relational Investors, a $6B activist fund. He was responsible for managing the fund’s consumer, healthcare and utility investments. Prior to Relational, Mr. Welling spent seven years as a Managing Director at Credit Suisse and Head of the Investment Banking Department’s Advisory Business. Mr. Welling joined Credit Suisse when the firm acquired HOLT Value Associates, where he was a Partner and Managing Director. Prior to HOLT, Mr. Welling was the Managing Director of Valuad U.S., a financial software and advisory business. Prior to Valuad U.S., he worked at leading consulting firms including A.T. Kearney and Marakon Associates. From 2022 to 2023, Mr. Welling was a member of the Board of Directors of NCR Corporation, a NYSE listed software- and services-led enterprise technology provider for the financial, retail, and hospitality industries where he Chaired the Special Committee and served on the Compensation and Human Resources Committee and the Audit Committee. From 2017 to 2022, Mr. Welling was a member of the Board of Directors of The Hain Celestial Group, a NASDAQ listed leading marketer, manufacturer and seller of organic and natural better-for-you-products where he was the Chair of the compensation committee and member of the Strategy Committee. From 2015 to 2020 Mr. Welling was a member of the Board of Directors of TiVo Corporation, a NASDAQ listed provider of digital entertainment technology solutions where he was the Chair of the compensation committee and a member of the Strategy Committee and the Corporate Governance and Nominating Committee. From 2015 to 2018, Mr. Welling served on the Board of Medifast, Inc., a NYSE listed manufacturer of medically based, proprietary healthy living and meal replacement products where he was a member of the Audit, Compensation, and Mergers and Acquisitions Committees. From January 2015 to August 2018, Mr. Welling served on the Board of Jamba, Inc., a NASDAQ listed leading restaurant retailer of better-for-you food and beverage offerings where he was the Chair of the compensation committee and a member of the Finance Committee. Mr. Welling was recognized by The National Association of Corporate Directors (NACD) as one of the 100 most influential directors in corporate boardrooms in 2018. From 2017 to 2019 he also served on the Corporate Governance Advisory Council of the Council of Institutional Investors. Mr. Welling also taught executive education courses at the Wharton School of Business, his alma mater. He previously served as Chairman of the Board of Directors for the university’s tennis program and as a member of the Wharton Executive Education Board. | ||

MR. WELLING IS WELL-QUALIFIED TO SERVE ON OUR BOARD DUE TO SIGNIFICANT EXPERIENCE IN THE AREAS OF INVESTMENTS, FINANCE AND CORPORATE GOVERNANCE. | |||

BRC Inc. | 15 | 2025 Proxy Statement |

Clayton Hutmacher Independent Age 64 Director Since June 2024 Committee Service: • Compensation Committee • Nominating and Corporate Governance Committee | Clayton Hutmacher is a director on our Board and currently serves as a member of the compensation committee and nominating and corporate governance committee. Mr. Hutmacher has been the President and Chief Executive Officer of the Special Operations Warrior Foundation since September 2018. Mr. Hutmacher was a career United States Army Officer and retired in 2018 having served over 40 years in uniform. As an Army Special Operations Aviator, he commanded at every level during his three tours with the 160th Special Operations Aviation Regiment, where he served as the MH-60 Direct Action Penetrator platoon leader, company operations officer, executive officer and commander of 1st Battalion, Regimental Commander, and the Commanding General of the U.S Army Special Operation Command, Tampa, Florida. Mr. Hutmacher’s last active duty assignment was as the deputy Commanding General of the United States Army Special Operations Command at Fort Bragg, NC. Mr. Hutmacher has a Bachelor’s Degree in Aerospace Management from Embry Riddle Aeronautical University, a Master’s Degree in National Security and Strategic Studies from the United States Naval Command and Staff College, and a Master’s Degree in Strategic Studies from the United States Army War College. | ||

MR. HUTMACHER IS QUALIFIED TO SERVE ON OUR BOARD DUE TO HIS EXTENSIVE LEADERSHIP AND STRATEGIC EXPERIENCE RELEVANT TO OUR PUBLIC BENEFIT MISSION. | |||

Stephen Kadenacy Age 56 Director Since April 2025 | Stephen Kadenacy is a director on our Board and has served as the Company’s Chief Financial Officer since September 2023. Mr. Kadenacy, who is the former Chief Financial Officer of AECOM, is a significant shareholder and has deep familiarity with BRCC’s operations and financial profile, having played an integral role in the business combination of BRCC and SilverBox, including serving as Chief Executive Officer of SilverBox Engaged Merger Corp until its merger with BRCC in February 2022. Mr. Kadenacy is a seasoned investment professional and former Fortune 200 operating executive with expertise in managing, building and growing global public organizations, most recently serving as Co-Managing Member of SilverBox Capital, an investment firm which he co-founded in 2017. With experience spanning over three decades, Mr. Kadenacy was also the CEO of Boxwood Merger Corp until its merger with Atlas Technical Consulting and then remained on the Board. Previously, Mr. Kadenacy held leadership roles at AECOM, a global engineering and technical services company, including serving as President, Chief Operating Officer, and Chief Financial Officer. Prior to his corporate career, Mr. Kadenacy was a Partner at KPMG in the Economic Consulting Practice and served as a member of the Board of Directors of ABM Industries, a provider of facility management services. Mr. Kadenacy also served on the Board of the YMCA of Greater Los Angeles and the Board of Trustees for UCLA’s Anderson School of Business. Mr. Kadenacy holds a bachelor’s degree in economics from UCLA and an MBA from USC. | ||

MR. KADENACY IS QUALIFIED TO SERVE ON OUR BOARD DUE TO HIS EXTENSIVE KNOWLEDGE OF THE COMPANY AND FINANCIAL EXPERTISE. | |||

BRC Inc. | 16 | 2025 Proxy Statement |

Sean Moriarty Independent Age 54 Director Since April 2025 | Sean Moriarty is a director on our Board. Mr. Moriarty is the chief executive officer of Primer, an artificial intelligence company, where he also serves on the board of directors. He is currently the lead independent director at Eventbrite, a publicly traded company, where he has served on the board of directors since 2010. From August 2014 to April 2023, Mr. Moriarty served as the chief executive officer of Leaf Group, a wholly owned subsidiary of Graham Holdings, a publicly traded company. Prior to its acquisition by Graham Holdings in June 2021, Mr. Moriarty served on the board of directors of Leaf Group, a publicly traded company, from August 2014 to June 2021. Mr. Moriarty previously served as the chief executive officer of Saatchi Online, which operated Saatchi Art, an online art gallery, from August 2013 to August 2014, prior to its acquisition by Leaf Group. From 2009 to 2012, Mr. Moriarty was an entrepreneur in residence at Mayfield Fund, a venture capital firm. From 2007 to 2009, Mr. Moriarty was president and chief executive officer of Ticketmaster, a live entertainment ticketing and marketing company, and he held various other positions at Ticketmaster from 2000 to 2006, including executive vice president, technology and chief operating officer. Mr. Moriarty served on the Ticketmaster board of directors from 2008 to 2009. Mr. Moriarty attended graduate school at Boston University and the University of South Carolina and earned his undergraduate degree from the University of South Carolina. | ||

MR. MORIARTY IS QUALIFIED TO SERVE ON OUR BOARD DUE TO HIS EXTENSIVE EXPERIENCE IN OPERATIONS, LEADERSHIP AND BRAND GROWTH. | |||

Kathryn Dickson Lead Independent Director Independent Age 60 Director Since August 2020 Committee Service: • Compensation Committee (Chair) • Nominating and Corporate Governance Committee | Kathryn Dickson is a director on our Board and currently serves as the Lead Independent Director of our Board, Chair of the compensation committee, and a member of the nominating and corporate governance committee. Ms. Dickson served as President of Manitoba Harvest, a global company that manufactures and markets plant-based-protein foods and beverages, from 2019 through 2020, and has since served in professional director roles as described below. Prior to Manitoba Harvest, Ms. Dickson served as Senior Vice President at Mattel, Inc., and President of its American Girl subsidiary from 2016 through 2018. Prior to American Girl, Ms. Dickson served as Chief Marketing Officer for News America Marketing Inc., a subsidiary of global media and information services company, News Corp, from 2015 to 2016. Ms. Dickson spent the majority of her career, more than 23 years, with General Mills, Inc. serving in marketing leadership and general management roles of increasing responsibility for some of the world’s best-known brands, concluding with her service as Vice President/Business Unit Director for the Betty Crocker, Pillsbury and Old El Paso global brands. Ms. Dickson served on the board of directors of Cooper Tire & Rubber Company from October 2018 until July 2021, and is currently on the board of Flexsteel Industries, Inc. where she has been an independent director since July 2021, and serves on their compensation committee and as Chairperson of their nominating and corporate governance committee. Ms. Dickson earned a Bachelor of Science degree from the United States Air Force Academy, and an MBA from the University of California, Los Angeles. She served as an officer in the U.S. Air Force, where she achieved the rank of Captain. | ||

MS. DICKSON IS QUALIFIED TO SERVE ON OUR BOARD BASED ON HER EXTENSIVE EXPERTISE IN DRIVING GROWTH THROUGH OMNICHANNEL AND DIGITAL STRATEGIES, BRAND BUILDING, MARKETING AND PRODUCT INNOVATION. | |||

BRC Inc. | 17 | 2025 Proxy Statement |

Chris Mondzelewski Age 51 Director Since January 2024 | Chris Mondzelewski is the President and Chief Executive Officer of BRCC and is a director on our Board. Prior to his appointment as Chief Executive Officer, Mr. Mondzelewski served President of the Company from June 2023 and as the Company’s Chief Marketing Officer from May 2023 to January 2024. Mr. Mondzelewski came to Black Rifle with more than 20 years of consumer marketing, business and leadership experience. Prior to his time at BRCC, Mr. Mondzelewski was at Mars Inc. for thirteen years, and held multiple leadership positions of increasing responsibility across the company including Chief Growth Officer, Senior VP North America Customer Development, and VP of Marketing. Prior to that, Mr. Mondzelewski spent 12 years at Kraft Foods where he led businesses in North America and China. Before his business career, Mr. Mondzelewski was a Marine for five years, deploying in support of Operation Desert Freedom. Mr. Mondzelewski has a strong personal connection to the military and first-responder community. Mr. Mondzelewski has a bachelor’s degree in chemical engineering from Vanderbilt University and an MBA in economics and marketing from the Kellogg School of Management at Northwestern University. | ||

MR. MONDZELEWSKI IS QUALIFIED TO SERVE ON OUR BOARD BASED ON HIS YEARS OF EXPERIENCE IN THE CONSUMER PACKAGED GOODS INDUSTRY, HIS EXECUTIVE LEADERSHIP EXPERIENCE, AND HIS ROLE AS CHIEF EXECUTIVE OFFICER OF THE COMPANY. | |||

Lawrence Molloy Independent Age 63 Director Since June 2024 Committee Service • Audit Committee (Chair) • Compensation Committee | Lawrence “Chip” Molloy is a director on our Board and currently serves as the Chair of the audit committee and a member of the compensation committee. Mr. Molloy brings finance, private equity and board experience to the Company. He was Chief Financial Officer of Sprouts Farmers Market, Inc. from September 2021 to December 2023. He also served as a director and chair of the audit and compensation committees of Sprouts’ board from 2012 to 2021 and Interim Chief Financial Officer of Sprouts from June 2019 to February 2020. Previously, Mr. Molloy served as a director and Chair of Torrid Inc.’s audit committee from 2018 to 2021 and Interim Chief Executive Officer of Torrid from January 2018 to August 2018. His previous roles include serving as Senior Advisor to Roark Capital Group, a private equity firm focused predominantly on the restaurant and retail sectors, as well as holding Chief Financial Officer roles at Under Armour Inc. and Petsmart, Inc. Mr. Molloy currently sits on the board of Pet Valu Holdings Ltd., where he has been a director since May 2023 and serves as the Chair of the audit committee and a member of the governance and nominating committee. Mr. Molloy also sits on the board of Sally Beauty Holdings, Inc., where he has been a director since July 2022 and serves as the Chair of the audit committee and serves as a member of the executive committee. Prior to his business career, Mr. Molloy served as a U.S. Navy fighter pilot for 10 years, later retiring from the Naval Reserve with the rank of Commander. Mr. Molloy holds an MBA from the University of Virginia and a Bachelor of Science in Computer Science from the U.S. Naval Academy. | ||

MR. MOLLOY IS QUALIFIED TO SERVE ON OUR BOARD DUE TO HIS EXTENSIVE EXECUTIVE AND FINANCE EXPERIENCE. | |||

BRC Inc. | 18 | 2025 Proxy Statement |

Committee Memberships | ||||||||||||||||||||

Name | Age1 | Director Since | Independent | Audit | Compensation | Nominating and Governance | ||||||||||||||

Evan Hafer | 48 | 2014 | | | • | |||||||||||||||

Steven Taslitz | 66 | 2017 | • | • | • | |||||||||||||||

Glenn Welling | 54 | 2022 | • | • | • | |||||||||||||||

Clayton Hutmacher | 64 | 2024 | • | | • | • | ||||||||||||||

Stephen Kadenacy | 56 | 2025 | ||||||||||||||||||

Sean Moriarty | 54 | 2025 | • | |||||||||||||||||

Kathryn Dickson | 60 | 2020 | • | | • | • | ||||||||||||||

Chris Mondzelewski | 51 | 2024 | ||||||||||||||||||

Lawrence Molloy | 63 | 2024 | • | • | • | |||||||||||||||

FY 2024 Meetings2 | | Board: 7 | 4 | 5 | 4 | |||||||||||||||

1. | As of April 15, 2025. |

2. | Messrs. Kadenacy and Moriarty were appointed to the Board on April 11, 2025 and are not included in the FY2024 Meeting Information. |

BRC Inc. | 19 | 2025 Proxy Statement |

• | that a majority of our board of directors consists of “independent directors,” as defined under the rules of the NYSE; |

• | that we have, to the extent applicable, a nominating committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

• | that any compensation committee be composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

• | for an annual performance evaluation of the nominating and corporate governance committee and compensation committee. |

BRC Inc. | 20 | 2025 Proxy Statement |

• | selecting and hiring our independent auditors, and approving the audit and non-audit services to be performed by our independent auditors; |

• | assisting the Board in evaluating the qualifications, performance and independence of our independent auditors; |

• | assisting the Board in monitoring the quality and integrity of our financial statements and our accounting and financial reporting; |

• | assisting the Board in monitoring our compliance with legal and regulatory requirements; |

• | reviewing the adequacy and effectiveness of our internal control over financial reporting processes; |

• | assisting the Board in monitoring the performance of our internal audit function; |

• | monitoring the performance of our internal audit function; |

• | reviewing with management and our independent auditors our annual and quarterly financial statements; |

• | establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; and |

• | preparing the audit committee report that the rules and regulations of the SEC require to be included herein. |

BRC Inc. | 21 | 2025 Proxy Statement |

• | reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer, evaluating our Chief Executive Officer’s performance in light of those goals and objectives, and, either as a committee or together with the other independent directors, determining and recommending to our Board our Chief Executive Officer’s compensation level based on such evaluation; |

• | reviewing and approving, or making recommendations to the Board with respect to, the compensation of our other executive officers, including annual base salary, bonus and equity-based incentives and other benefits; |

• | reviewing and recommending the compensation of our directors; |

• | reviewing and discussing annually with management our compensation disclosure required by SEC rules; |

• | if necessary, preparing the compensation committee report required by the SEC to be included in our annual proxy statement; and |

• | reviewing and making recommendations with respect to our equity compensation plans. |

• | assisting our Board in identifying prospective director nominees and recommending nominees to the Board; |

• | overseeing the evaluation of the Board and management; |

• | reviewing developments in corporate governance practices and developing and recommending a set of corporate governance guidelines; and |

• | recommending members for each committee of our Board. |

BRC Inc. | 22 | 2025 Proxy Statement |

BRC Inc. | 23 | 2025 Proxy Statement |

BRC Inc. | 24 | 2025 Proxy Statement |

BRC Inc. | 25 | 2025 Proxy Statement |

• | an annual cash retainer of $50,000; |

• | an additional annual cash retainer of $10,000, $6,000 and $5,000 for service as members of our audit committee, compensation committee and nominating and corporate governance committee, respectively; |

• | an additional annual cash retainer of $20,000, $10,000 and $9,000 for service as chair of our audit committee, compensation committee and nominating and corporate governance committee, respectively; |

• | an initial grant of restricted stock units (“RSUs”) having a grant date fair value of $150,000 on the date of each such director’s appointment to our Board of Directors, vesting in full on the third anniversary of the date of grant; and |

• | an annual grant of RSUs having a grant date fair value of $125,000, vesting in full on the first anniversary of the date of grant. |

BRC Inc. | 26 | 2025 Proxy Statement |

Name | Fees earned or paid in cash1 ($) | Stock Awards2 ($) | Total ($) | ||||||||

Evan Hafer3 | — | — | — | ||||||||

Kathryn Dickson | 85,000 | 125,000 | 210,000 | ||||||||

Clayton Hutmacher | 61,000 | 275,000 | 336,000 | ||||||||

Steven Taslitz | 65,000 | 125,000 | 190,000 | ||||||||

Lawrence Molloy | 76,000 | 275,000 | 351,000 | ||||||||

Glenn Welling | 76,000 | 125,000 | 201,000 | ||||||||

Thomas Davin4 | 50,000 | 125,000 | 175,000 | ||||||||

George Munoz5 | — | — | — | ||||||||

1. | All directors other than Mr. Molloy took their cash payments in the form of RSU grants. The assumptions made in calculating the grant date fair value of these awards are set forth in Note 14. Equity-Based Compensation, to the consolidated financial statements in our 2024 Annual Report. |

2. | Consists of grants of RSUs. The assumptions made in calculating the grant date fair value of these awards are set forth in Note 14. Equity-Based Compensation, to the consolidated financial statements in our 2024 Annual Report. |

3. | Mr. Hafer is an executive officer who did not receive any additional compensation for his services provided as a director. |

4. | The amounts reflected herein for Mr. Davin include a total of 46,917 RSUs. Of this amount, 3,351 RSUs vested on August 1, 2024 with the remaining amounts forfeited in connection with Mr. Davin’s resignation from the Board on September 13, 2024. |

5. | George Munoz did not stand for re-election at the 2024 Annual Meeting of Stockholders. |

Name | Stock Awards Outstanding (#) | Option Awards Outstanding (#) | ||||||

Kathryn Dickson1 | 57,925 | — | ||||||

Clayton Hutmacher | 50,748 | — | ||||||

Steven Taslitz2 | 55,245 | — | ||||||

Lawrence Molloy | 45,681 | — | ||||||

Glenn Welling | 48,700 | — | ||||||

Sean Moriarty | — | — | ||||||

1. | The number of Stock Awards Outstanding include (i) 49,906 shares of Class A Common Stock issuable upon settlement of unvested RSUs, and (ii) 8,019 Class A Common Stock for which 57 Incentive Units held by Ms. Dickson would have been converted as of December 31, 2024. |

2. | The number of Stock Awards Outstanding include (i) 47,226 shares of Class A Common Stock issuable upon settlement of unvested RSUs, and (ii) 8,019 shares of Class A Common Stock for which 57 Incentive Units held by Mr. Taslitz would have been converted as of December 31, 2024. |

BRC Inc. | 27 | 2025 Proxy Statement |

BRC Inc. | 28 | 2025 Proxy Statement |

Fee Category | 2024 ($) | 2023 ($) | ||||||

Audit Fees | 1,020 | 910 | ||||||

Audit-Related Fees | — | — | ||||||

Tax Fees | — | — | ||||||

All Other Fees | — | 7 | ||||||

Total Fees | 1,020 | 917 | ||||||

BRC Inc. | 29 | 2025 Proxy Statement |

(a) | the audit committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2024 with the Company’s management; |

(b) | the audit committee has discussed with EY, the matters required to be discussed under the rules adopted by the Public Company Accounting Oversight Board (“PCAOB”) and the SEC; and |

(c) | the audit committee has received and reviewed the written disclosures and the letter from EY, required by applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the audit committee concerning independence, and has discussed with EY its independence from the Company; and |

(d) | based on the review and discussion referred to in paragraphs (a) through (c) above, the audit committee recommended to the Company’s Board of Directors that the audited financial statements be included in BRC Inc.’s Annual Report on Form 10-K for the year ended December 31, 2024, for filing with the SEC. |

Members of the audit committee: | |||

Lawrence Molloy | |||

Steven Taslitz | |||

Glenn Welling |

BRC Inc. | 30 | 2025 Proxy Statement |

Name | Age | Position(s) Held | ||||||

Evan Hafer | 48 | Founder, Executive Chairman | ||||||

Mat Best | 38 | Chief Branding Officer | ||||||

Christopher Mondzelewski | 51 | President and CEO, Director | ||||||

Stephen Kadenacy | 56 | Chief Financial Officer, Director | ||||||

Andrew McCormick | 39 | General Counsel and Corporate Secretary | ||||||

Christopher Clark | 58 | Chief Technology and Operations Officer | ||||||

BRC Inc. | 31 | 2025 Proxy Statement |

BRC Inc. | 32 | 2025 Proxy Statement |

• | Chris Mondzelewski, our current President and Chief Executive Officer |

• | Christopher Clark, our Chief Technology and Operations Officer |

• | Andrew McCormick, our General Counsel and Corporate Secretary |

• | Pay for Performance. We design our executive compensation program to align pay with company performance. |

• | Significant Portion of Compensation is at Risk. A significant portion of executive compensation is “at risk” based on our performance, including short-term cash incentives and long-term equity incentives, to align the interests of our executive officers and stockholders. |

• | Independent Compensation Advisor Reports Directly to the Compensation Committee. The compensation committee engages its own compensation consultant to assist with making compensation decisions. |

• | Annual Market Review of Executive Compensation. The compensation committee and its compensation consultant annually assess competitiveness and market alignment of our compensation plans and practices. |

• | Multi-Year Vesting Requirements. The equity awards granted to our NEOs vest over multi-year periods, consistent with current market practice and our retention objectives. |

• | Minimize Inappropriate Risk Taking. Our compensation program is weighted toward long-term incentive compensation to discourage short-term risk taking. |

• | Competitive Peer Group. Our compensation committee selects our peers from companies that are similar to us with respect to market capitalization, business strategy, and revenue. |

• | Stock Ownership Guidelines for Executives and Directors. We maintain stock ownership guidelines for our NEOs and non-employee directors to encourage ownership of our common stock and alignment with the long-term interests of our stockholders. |

BRC Inc. | 33 | 2025 Proxy Statement |

Yeti Holdings, Inc. | Sovos Brands, Inc. | Bark, Inc. | |||||

Krispy Kreme, Inc. | Westrock Coffee Company | The Vita Coco Company, Inc. | |||||

Celsius Holdings, Inc. | Freshpet, Inc. | Vital Farms, Inc. | |||||

Dutch Bros Inc. | Portillo’s Inc. | The Duckhorm Portfolio, Inc | |||||

Beyond Meat, Inc. | The Honest Company, Inc. | Zevia PBC | |||||

BRC Inc. | 34 | 2025 Proxy Statement |

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)1 | Option Awards ($)2 | All Other Compensation ($) | Total ($) | ||||||||||||||||

Chris Mondzelewski3 President and Chief Executive Officer | 2024 | 598,077 | 243,500 | 625,000 | 1,875,000 | 34 | 3,341,611 | ||||||||||||||||

2023 | 285,963 | — | 925,000 | 1,875,000 | 7,271 | 3,093,234 | |||||||||||||||||

Christopher Clark4 Chief Technology and Operations Officer | 2024 | 400,000 | 162,300 | 225,000 | 675,000 | 34 | 1,462,334 | ||||||||||||||||

Andrew McCormick5 General Counsel and Corporate Secretary | 2024 | 350,000 | 142,000 | 100,000 | 300,000 | 11,582 | 903,582 | ||||||||||||||||

1. | Amounts shown include the grant date fair values of RSU awards granted in the year indicated. The assumptions made in calculating the grant date fair value of these awards are set forth in Note 14. Equity-Based Compensation, to the consolidated financial statements in our 2024 Annual Report. |

2. | Stock options granted to employees under the 2022 Plan (as defined below) vest ratably over three years and expire after seven years. The assumptions made in calculating the grant date fair value of the stock options are set forth in Note 14. Equity-Based Compensation, to the consolidated financial statements in our Annual Report. |

3. | Mr. Mondzelewski commenced employment with the Company in May of 2023 and was appointed to the position of Chief Executive Officer effective January 1, 2024. Amounts listed in the “All Other Compensation” column include insurance premiums paid by employer for life insurance. |

4. | Amounts listed in the “All Other Compensation” column include insurance premiums paid by employer for life insurance. |

5. | Amounts listed in the “All Other Compensation” column include insurance premiums paid for life insurance and employer’s portion of 401(k) plan funding. |

• | attract, retain and motivate senior management leaders who are capable of advancing our mission and strategy and ultimately, creating and maintaining our long-term equity value; |

• | retain leaders who engage in a collaborative approach and possess the ability to execute our business strategy in an industry characterized by competitiveness and growth; |

• | reward senior management in a manner aligned with our financial performance; and |

• | align senior management’s interests with our equity owners’ long-term interests through equity participation and ownership. |

BRC Inc. | 35 | 2025 Proxy Statement |

Named Executive Officer | 2024 Base Salary (Annualized) ($) | ||||

Chris Mondzelewski | 600,000 | ||||

Christopher Clark | 400,000 | ||||

Andrew McCormick | 350,000 | ||||

Named Executive Officer | 2024 Target Bonus Opportunity | ||||

Chris Mondzelewski | 100% | ||||

Christopher Clark | 75% | ||||

Andrew McCormick | 75% | ||||

BRC Inc. | 36 | 2025 Proxy Statement |

• | Stock Options (75% of grant value): Provide strong incentives for our executive officers to increase the value of our common stock over the long term, and closely align the interests of our executives with those of our stockholders. The stock options we grant vest over three years, with one-third of the shares subject to the option vesting on each anniversary of the vesting commencement date, subject to the recipient’s continued employment or service with us on each vesting date. Options have a term of seven years from the date of grant. |

• | RSU Awards (25% of grant value): Granted because they are less dilutive to our stockholders, as fewer shares of our common stock are granted to achieve an equivalent value relative to stock options, and because RSU awards are an effective retention tool that maintain value even in cases where the share price is trading lower than the initial grant price. The RSUs we grant vest in equal annual increments over three years, subject to the recipient’s continued employment or service with us on each vesting date. |

BRC Inc. | 37 | 2025 Proxy Statement |

BRC Inc. | 38 | 2025 Proxy Statement |

BRC Inc. | 39 | 2025 Proxy Statement |

Option Awards1 | Stock Awards2 | ||||||||||||||||||||||||||||

Name | Grant Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested3 (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units, or Other Rights That Have Not Vested ($) | ||||||||||||||||||||

Chris Mondzelewski President and Chief Executive Officer | 5/5/2023 | 50,876 | 101,752 | 5.38 | 5/4/2030 | 55,762 | 176,766 | — | — | ||||||||||||||||||||

8/15/2023 | 191,076 | 382,154 | 4.45 | 8/14/2030 | 71,162 | 225,584 | — | — | |||||||||||||||||||||

2/23/2024 | — | 860,664 | 3.91 | 2/22/2031 | 159,847 | 506,715 | — | — | |||||||||||||||||||||

Christopher Clark Chief Technology and Operations Officer | 5/16/2022 | — | — | — | — | 30,441 | 96,498 | — | — | ||||||||||||||||||||

5/22/2022 | 64,386 | 32,193 | 9.74 | 5/21/2029 | — | — | — | — | |||||||||||||||||||||

4/21/2023 | 57,523 | 115,047 | 5.05 | 4/20/2030 | 21,122 | 66,957 | — | — | |||||||||||||||||||||

8/15/2023 | 26,147 | 52,295 | 4.45 | 8/14/2030 | 9,738 | 30,869 | — | — | |||||||||||||||||||||

2/23/2024 | — | 309,839 | 3.91 | 2/22/2031 | 57,545 | 182,418 | — | — | |||||||||||||||||||||

Andrew McCormick General Counsel and Corporate Secretary | 9/13/2021 | — | — | — | — | — | — | 53,445 | 169,421 | ||||||||||||||||||||

4/21/2023 | 35,952 | 71,904 | 5.05 | 4/20/2030 | 13,202 | 41,850 | — | — | |||||||||||||||||||||

9/19/2023 | — | — | — | — | 54,902 | 174,039 | — | — | |||||||||||||||||||||

2/23/2024 | — | 137,706 | 3.91 | 2/22/2031 | 25,575 | 81,073 | — | — | |||||||||||||||||||||

1. | Stock options granted vest ratably over three years on an annual basis and expire after seven years. |

2. | Stock awards include RSUs and Incentive Unit awards. RSU awards vest annually over three years. The unvested Incentive Units held by our NEOs generally vest over a four-year period — 25% on the first anniversary of the date of grant and then in equal installments at the end of each subsequent quarter over the next three years, in each case, subject to continued employment through such date. The value for each award was calculated by multiplying the number of shares of common stock underlying the unvested portion of the award by $3.17, the closing price for our Class A Common Stock on the NYSE on the last trading day of 2024. |

3. | Represents the number of shares of Class A Common Stock for which 375 unvested Incentive Units held by Mr. McCormick would have been converted as of December 31, 2024. |

BRC Inc. | 40 | 2025 Proxy Statement |

Number of Shares to be Issued Upon Exercise of Outstanding Options, RSUs, PSUs, and Incentive Units (#) (a) | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights1(b) ($) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (#) (c) | |||||||||

Equity compensation plans approved by security holders2 | 16,131,480 | 4.41 | 18,328,764 | ||||||||

Equity compensation plans not approved by security holders3 | 1,221,857 | — | — | ||||||||

Total | 17,353,337 | 4.41 | 18,238,764 | ||||||||

1. | The weighted average exercise price is calculated based solely on the exercise price of outstanding stock options and does not take into account outstanding RSUs, PSUs or Incentive Units, which have no exercise price. |

2. | Equity compensation plans approved by our security holders consist of the 2022 Plan and the BRC Inc. 2022 Employee Stock Purchase Plan, under which 11,701,408 and 6,627,356 shares of Class A Common Stock, respectively, were available for future issuance as of December 31, 2024. |

3. | Represents the number of shares of Class A Common Stock for which 8,472 Incentive Units would be converted as of December 31, 2024. In connection with the Business Combination, we assumed the Incentive Unit Plan, which has not been approved by our stockholders. No additional awards may be issued under the Incentive Unit Plan. |

BRC Inc. | 41 | 2025 Proxy Statement |

• | each person who is the beneficial owner of more than 5% of the outstanding shares of Class A common stock; |

• | each of our NEOs and directors; and |

• | all of our executive officers and directors as a group. |

BRC Inc. | 42 | 2025 Proxy Statement |

Name of Beneficial Holder | Class A Common Stock | Shares Issuable Within 60 Days1 | Stock Options Exercisable Within 60 Days | Class B Common Stock2 | Total Class A Common Stock Beneficially Owned | Percentage of Class A Common Stock | Percentage of Total Voting Power | ||||||||||||||||

Directors and Officers | |||||||||||||||||||||||

Evan Hafer3 | 14,035,560 | — | — | 119,764,066 | 133,799,626 | 67.4% | 62.8% | ||||||||||||||||

Lawrence Molloy | — | — | — | — | — | — | — | ||||||||||||||||

Kathryn Dickson | 182,301 | 44,209 | — | 117,235 | 343,745 | * | * | ||||||||||||||||

Clayton Hutmacher | 7,599 | — | — | — | 7,599 | * | * | ||||||||||||||||

Steven Taslitz | 75,447 | 42,869 | — | 1,689,9274 | 1,808,243 | 2.3% | * | ||||||||||||||||

Glenn Welling | 14,119,5705 | 43,606 | — | — | 14,163,176 | 18.0% | 6.6% | ||||||||||||||||

Sean Moriarty | — | — | — | — | — | — | — | ||||||||||||||||

Chris Mondzelewski | 86,765 | 27,881 | 579,716 | — | 694,362 | * | * | ||||||||||||||||

Stephen Kadenacy | 1,053,435 | — | 334,994 | — | 1,388,429 | 1.8% | * | ||||||||||||||||

Christopher Clark | 70,802 | 10,561 | 308,858 | — | 390,221 | * | * | ||||||||||||||||

Andrew McCormick | 30,013 | 6,601 | 117,806 | 24,823 | 179,243 | * | * | ||||||||||||||||

All directors and executive officers as a group (12 persons) | 16,125,932 | 175,727 | 1,341,374 | 121,596,051 | 139,239,084 | 69.0% | 64.9% | ||||||||||||||||

Other Shareholders Over 5% | |||||||||||||||||||||||

EKNRH Holdings LLC6 | — | — | — | 30,142,374 | 30,142,374 | 27.7% | 14.1% | ||||||||||||||||

Matthew Best | — | — | — | 29,176,726 | 29,176,726 | 27.1% | 13.7% | ||||||||||||||||

Marianne Hellauer7 | — | — | — | 26,648,846 | 26,648,846 | 25.3% | 12.5% | ||||||||||||||||

John Miller8 | 500,000 | — | — | 14,243,594 | 14,743,594 | 15.9% | 6.9% | ||||||||||||||||

Thomas Davin9 | 13,698 | — | — | 6,907,463 | 6,921,161 | 8.1% | 3.2% | ||||||||||||||||

Funds and accounts managed by Engaged Capital5 | 13,535,560 | — | — | — | 13,535,560 | 17.2% | 6.4% | ||||||||||||||||

* | Less than 1% |

1. | Consists of shares of Class A Common Stock issuable upon the vesting of RSUs on or before May 14, 2025. |

BRC Inc. | 43 | 2025 Proxy Statement |

2. | Each share of Class B Common Stock relates to a corresponding number of Common Units and such shares are subject to forfeiture upon redemption of the corresponding Common Units, which units may be redeemed by the holder at any time in exchange for a corresponding number of shares of Class A Common Stock. |

3 | Based on information set forth in Schedule 13G/A filed with the SEC on November 14, 2024. Consists of (i) 30,142,374 shares of Class B Common Stock held through EKNRH Holdings LLC, an entity managed by Mr. Hafer, and (ii) 14,035,560 shares of Class A Common Stock and 89,621,692 shares of Class B Common Stock, which shares include the shares reported as held by Mr. Best, Engaged Capital, Ms. Hellauer and John Miller, that may be deemed to be beneficially owned by Mr. Hafer, given that, pursuant to the Investor Rights Agreement, Mr. Hafer has a proxy to vote such shares with respect to director elections. The number of shares subject to the Investor Rights Agreement is based on the most recent information available to the Company. Mr. Hafer disclaims any beneficial ownership of the reported shares other than with respect to shares held by EKNRH Holdings LLC and other than to the extent of any pecuniary interest Mr. Hafer may have therein, directly or indirectly. |

4 | Includes 3,724 shares of Class B Common Stock held by Mr. Taslitz and 1,686,203 shares of Class B Common Stock held by a trust for which Mr. Taslitz is acting as a trustee and which shares may therefore be deemed to be beneficially owned by Mr. Taslitz. Mr. Taslitz disclaims any beneficial ownership of the reported shares held by such trusts other than to the extent of any pecuniary interest Mr. Taslitz may have therein, directly or indirectly. For the description of an all-asset security package which includes all such shares, see “Other Governance Matters – Prohibition of Certain Types of Transactions.” |

5 | Includes (i) 77,918 shares of Class A Common Stock owned by Mr. Welling and (ii) 13,535,560 shares of Class A Common Stock held by Engaged Capital Flagship Master Fund, LP (“Engaged Capital FMF”), as the general partner and investment adviser of Engaged Capital FMF and the investment adviser of the Engaged Capital Account, and Glenn Welling, as the Founder and Chief Investment Officer of Engaged Capital and the sole member of Engaged Capital Holdings, LLC (the managing member of Engaged Capital), may be deemed to beneficially own the 13,535,560 shares owned in the aggregate by Engaged Capital FMF and held in the Engaged Capital Account. Mr. Welling disclaims any beneficial ownership of the reported shares other than to the extent of any pecuniary interest Mr. Welling may have therein, directly or indirectly. Mr. Welling is also a trustee of a trust that owns 506,092 shares of Class A Common Stock of the Company and, as such, may be deemed to be the beneficial owner of such shares. The principal business address of Glenn Welling and Engaged Capital is c/o Engaged Capital, LLC, 610 Newport Center Drive, Suite 250, Newport Beach, CA 92660. |

6 | EKNRH Holdings LLC is an entity managed by Evan Hafer and, as such, Evan Hafer is the beneficial owner of the shares held by EKNRH Holdings LLC. |

7 | Based on information set forth in a Schedule 13G filed with the SEC on February 14, 2023 by Marianne Hellauer. Ms. Hellauer serves as trustee for trusts holding 26,648,846 shares of Class B Common Stock. Ms. Hellauer reported that she has sole voting and dispositive power with respect to all such shares. Ms. Hellauer disclaims any beneficial ownership of the reported shares other than to the extent of any pecuniary interest Ms. Hellauer may have therein, directly or indirectly. |

8 | Based on information set forth in a Schedule 13G filed with the SEC on February 14, 2023 by John Miller. Mr. Miller serves as trustee for trusts and as manager of other entities holding 500,000 shares of Class A Common Stock and 14,243,594 shares of Class B Common Stock. Mr. Miller reported that he has sole voting and dispositive power with respect to all such shares. Mr. Miller disclaims any beneficial ownership of the reported shares other than to the extent of any pecuniary interest Mr. Miller may have therein, directly or indirectly. |

9 | Based on information set forth in Schedule 13G/A filed with the SEC on February 14, 2025 by Thomas Davin. |

BRC Inc. | 44 | 2025 Proxy Statement |

• | Christopher Clark: One transaction related to tax withholding in connection with the vesting of restricted stock units on April 21, 2024, which was subsequently reported on a Form 5, timely filed with the SEC on February 14, 2025; and |

• | Andrew McCormick: One transaction related to tax withholding in connection with the vesting of restricted stock units on April 21, 2024, which was subsequently reported on a Form 5, timely filed with the SEC on February 14, 2025. |

BRC Inc. | 45 | 2025 Proxy Statement |

• | the amounts involved exceeded or will exceed $120,000; and |

• | any of our directors, executive officers or beneficial holders of more than 5% of any class of our capital stock had or will have a direct or indirect material interest. |

BRC Inc. | 46 | 2025 Proxy Statement |

BRC Inc. | 47 | 2025 Proxy Statement |

BRC Inc. | 48 | 2025 Proxy Statement |

BRC Inc. | 49 | 2025 Proxy Statement |