January 13, 2026 Black Rifle Coffee Company 2026 Investor Presentation - ICR GREAT MISSION GREAT PRODUCT NO COMPROMISE

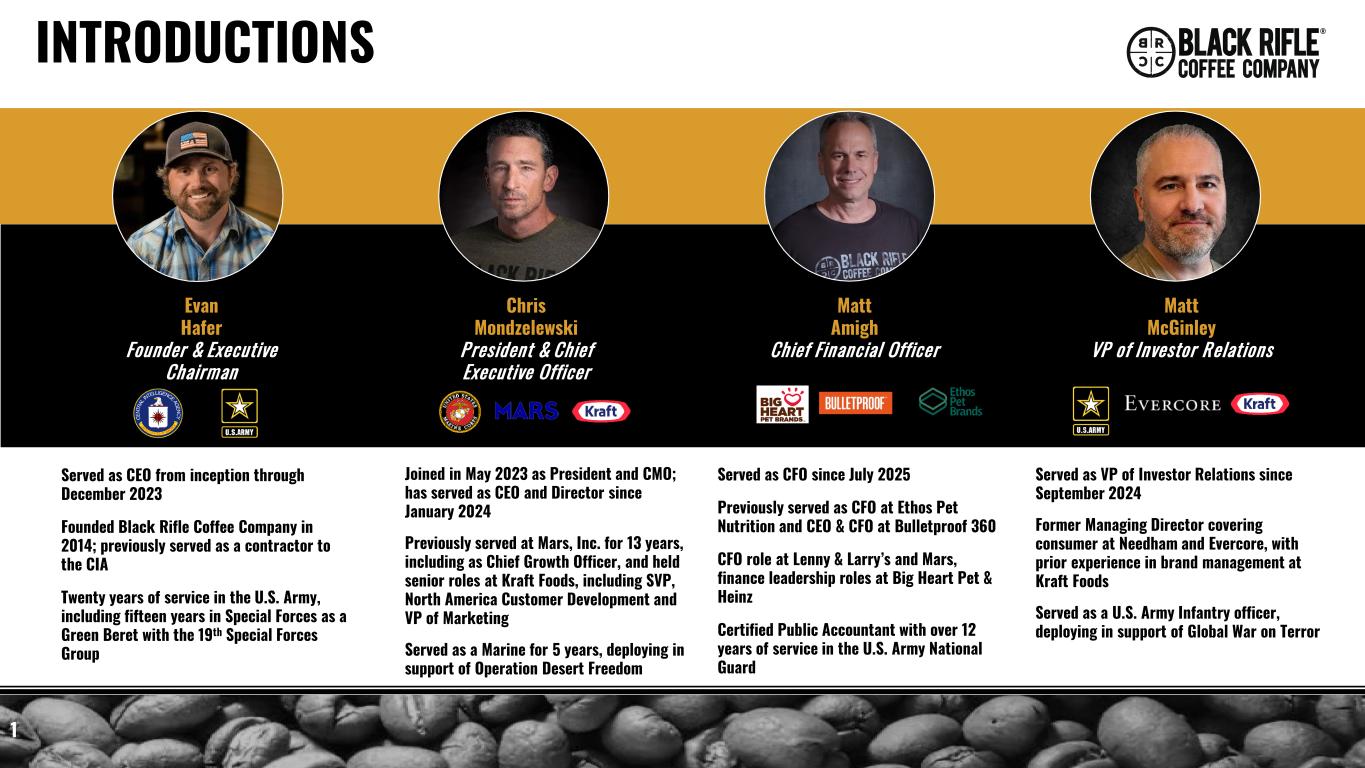

1 INTRODUCTIONS Joined in May 2023 as President and CMO; has served as CEO and Director since January 2024 Previously served at Mars, Inc. for 13 years, including as Chief Growth Officer, and held senior roles at Kraft Foods, including SVP, North America Customer Development and VP of Marketing Served as a Marine for 5 years, deploying in support of Operation Desert Freedom Served as CFO since July 2025 Previously served as CFO at Ethos Pet Nutrition and CEO & CFO at Bulletproof 360 CFO role at Lenny & Larry’s and Mars, finance leadership roles at Big Heart Pet & Heinz Certified Public Accountant with over 12 years of service in the U.S. Army National Guard Matt Amigh Chief Financial Officer Served as VP of Investor Relations since September 2024 Former Managing Director covering consumer at Needham and Evercore, with prior experience in brand management at Kraft Foods Served as a U.S. Army Infantry officer, deploying in support of Global War on Terror Chris Mondzelewski President & Chief Executive Officer Matt McGinley VP of Investor Relations Served as CEO from inception through December 2023 Founded Black Rifle Coffee Company in 2014; previously served as a contractor to the CIA Twenty years of service in the U.S. Army, including fifteen years in Special Forces as a Green Beret with the 19th Special Forces Group Evan Hafer Founder & Executive Chairman

2 This investor presentation (this “Presentation”) is for informational purposes only. The information contained herein does not purport to be all-inclusive and none of BRC Inc. (“the Company” “we,” “us,” and “our”) or its respective affiliates makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. The Company has not verified, and will not verify, any part of this Presentation. The recipient should make its own independent investigations and analyses of the Company and its own assessment of all information and material provided, or made available, by the Company or any of its respective directors, officers, employees, affiliates, agents, advisors or representatives. This Presentation does not constitute a solicitation of a proxy, consent or authorization with respect to any securities. This Presentation shall also not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any securities. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. Forward-Looking Statements This presentation contains forward-looking statements about the Company and its industry that involve substantial risks and uncertainties. All statements other than statements of historical fact contained in this presentation, including statements regarding the Company’s intentions, beliefs or current expectations concerning, among other things, the Company’s financial condition, liquidity, prospects, growth, strategies, future market conditions, developments in the capital and credit markets and expected future financial performance, as well as any information concerning possible or assumed future results of operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential, ”predict,” “project,” “should,” “will,” “would” and similar expressions, but the absence of these words does not mean that a statement is not forward-looking. The events and circumstances reflected in the Company’s forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Factors that may cause such forward-looking statements to differ from actual results include, but are not limited to: competition and our ability to grow, manage sustainable expansion, and retain key employees; failure to compete effectively with other producers, distributors and retailers of coffee and energy drinks; our limited operating history, which may hinder the successful execution of strategic initiatives and make it difficult to assess future risks and challenges; challenges in managing rapid growth, inventory needs, and relationships with key business partners; inability to raise additional capital necessary for business development; failure to achieve or sustain long-term profitability; inability to effectively manage debt obligations; failure to maximize the value of assets received through bartering transactions; negative publicity affecting our brand, reputation, or that of key employees; failure to uphold our position as a supportive member of the Veteran, military and first-responder communities, or other factors negatively affecting brand perception; inability to establish and maintain strong brand recognition through intellectual property or other means; shifts in consumer spending, lack of interest in new products or changes in brand perception upon evolving consumer preferences and tastes, including due to shifts in demographic or health and wellness trends, reduction in discretionary spending and price increases, and our ability to anticipate or react to these changes; price changes that are insufficient to offset cost increases and maintain profitability or that result in sales volume declines associated with pricing elasticity; unsuccessful marketing campaigns that incur costs without attracting new customers or realizing higher revenue; failure to attract new customers or retain existing customers; risks associated with reliance on social media platforms, including dependence on third-party platforms for marketing and engagement; declining performance of the direct to consumer revenue channel; inability to effectively manage or scale distribution through Wholesale business partners, particularly key Wholesale partners; failure to manage supply chain operations effectively, including inaccurate forecasting of raw material and co- manufacturing requirements; loss of one or more co-manufacturers or production delays, quality issues, or labor-related disruptions affecting manufacturing output; supply chain disruptions or failures by third-party suppliers to deliver coffee, store supplies, RTD beverage ingredients, or merchandise, including disruptions caused by external factors; ongoing risks related to supply chain volatility and reliability, including tariffs, political and climate risks; fluctuations in the market for high-quality coffee beans and other key commodities; unpredictable changes in the cost and availability of real estate, labor, raw materials, equipment, transportation, or shipping; failure to successfully improve profitability of existing Black Rifle Coffee shops, including challenges or delays with the implementation of operational and strategic changes; risks related to long-term, non-cancelable lease obligations and other real estate-related concerns; inability of franchise partners to successfully operate and manage their franchise locations; failure to maintain high-quality customer experiences for retail partners and end users, including production defects or issues caused by co-manufacturers that negatively impact product quality and brand reputation; failure to comply with food safety regulations or maintain product quality standards; difficulties in successfully expanding into new domestic and international markets; failure to comply with federal, state, and local laws and regulations, or inability to prevail in civil litigation matters; risks related to potential unionization of employees; failure to execute our operational improvement plan to reduce costs and improve efficiency of certain company-wide functions; failure to protect against cybersecurity threats, software vulnerabilities, or hardware security risks; and other risks and uncertainties indicated in our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the Securities and Exchange Commission (the “SEC”) on March 3, 2025 including those set forth under “Item 1A. Risk Factors “included therein, as well as in our other filings with the SEC. Such forward-looking statements are based on information available as of the date of this presentation and the Company’s current beliefs and expectations concerning future developments and their effects on the Company, and speak only as of the date of this presentation. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not place undue reliance on these forward-looking statements as predictions of future events. Although the Company believes that it has a reasonable basis for each forward-looking statement contained in this presentation, the Company cannot guarantee that the future results, growth, performance or events or circumstances reflected in these forward-looking statements will be achieved or occur at all. The Company does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Forward Looking Non-GAAP Financial Measures This presentation includes certain forward-looking non-GAAP financial measures, specifically Adjusted EBITDA. We have not reconciled forward-looking Adjusted EBITDA to its most directly comparable GAAP measure, net income (loss), in reliance on the unreasonable efforts exception provided under Item10(e)(1)(i)(B) of Regulation S-K. We cannot predict with reasonable certainty the ultimate outcome of certain components of such reconciliation, including market-related assumptions that are not within our control, or others that may arise, without unreasonable effort. For these reasons, we are unable to assess the probable significance of the unavailable information, which could materially impact the amount of future net income (loss). See “Non-GAAP Financial Measures” for additional important information regarding Adjusted EBITDA. DISCLAIMER

3 Non-GAAP Financial Measures To evaluate the performance of our business, we rely on both our results of operations recorded in accordance with generally accepted accounting principles in the United States("GAAP") and certain non-GAAP financial measures, including EBITDA and Adjusted EBITDA. These measures, as defined below, are not defined or calculated under principles, standards or rules that comprise GAAP. Accordingly, the non-GAAP financial measures we use and refer to should not be viewed as a substitute for performance measures derived in accordance with GAAP. Our definitions of EBITDA and Adjusted EBITDA described below are specific to our business and you should not assume that they are comparable to similarly titled financial measures of other companies. We define EBITDA as net income (loss) before interest, tax expense, depreciation and amortization expense. We define Adjusted EBITDA, as EBITDA adjusted for equity-based compensation, system implementation costs, write-off of site development costs, non-routine legal expenses, transaction expenses, and restructuring fees and related costs. When used in conjunction with GAAP financial measures, we believe that EBITDA and Adjusted EBITDA are useful supplemental measures of operating performance and liquidity because these measures facilitate comparisons of historical performance by excluding non-cash items such as equity-based compensation and other amounts not directly attributable to our primary operations, such as system implementation costs, write-off of site development costs, non-routing legal expense, restructuring fees and related costs, RTD transformation costs and loss on impairment of assets. Adjusted EBITDA is also a key metric used internally by our management to evaluate performance and develop internal budgets and forecasts. EBITDA and Adjusted EBITDA have limitations as an analytical tool and should not be considered in isolation or as a substitute for analyzing our results as reported under GAAP and may not provide a complete understanding of our operating results as a whole. Some of these limitations are (i) they do not reflect changes in, or cash requirements for, our working capital needs, (ii) they do not reflect our interest expense or the cash requirements necessary to service interest or principal payments on our debt, (iii) they do not reflect our tax expense or the cash requirements to pay our taxes, (iv) they do not reflect historical capital expenditures or future requirements for capital expenditures or contractual commitments, (v) although equity-based compensation expenses are non-cash charges, we rely on equity compensation to compensate and incentivize employees, directors and certain consultants, and we may continue to do so in the future and (vi) although depreciation, amortization and impairments are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and these non-GAAP measures do not reflect any cash requirements for such replacements. Preliminary Estimates The estimated results in this Presentation represent the Company’s preliminary estimates of certain financial results for the year ended December 31, 2025, based on currently available information. The Company has not yet finalized its results for this period and its consolidated financial statements as of and for the year ended December 31, 2025 are not currently available. The Company’s actual results remain subject to the completion of the quarter-end closing process as well as a review by management and the Company’s board of directors, including the audit committee. While carrying out such procedures, the Company may identify items that require it to make adjustments to the preliminary estimates of its results set forth herein. As a result, the Company’s actual results could be different from those set forth herein and the differences could be material. Therefore, a reader should not place undue reliance on these preliminary estimates of the Company’s results. The preliminary estimates of the Company’s results included herein have been prepared by, and are the responsibility of, the Company’s management. The Company’s independent auditors have not audited, reviewed or compiled such preliminary estimates of the Company’s results. The preliminary estimates of certain financial results presented herein should not be considered a substitute for the information to be filed with the Securities and Exchange Commission in the Company’s Annual Report on Form 10-K for the year ended December 31, 2025 once it becomes available. Use of Projections This presentation contains long-term financial targets with respect to the Company’s projected financial results, including Revenue, Gross Margin and Adjusted EBITDA. The Company’s independent auditors have not audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this presentation. These projections should not be relied upon as being necessarily indicative of future results. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of the Company or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Industry and Market Data This presentation also contains estimates and other statistical data made by independent parties and by the Company relating to market size and growth and other data about the Company’s industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of the future performance of the markets in which the Company operates are necessarily subject to a high degree of uncertainty and risk. Industry publications and third- party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Our estimates of the potential market opportunities for our product candidates include several key assumptions based on our industry knowledge, industry publications, third-party research and other surveys, which may be based on a small sample size and may fail to accurately reflect market opportunities. While we believe that our internal assumptions are reasonable, and management is responsible for the accuracy of such assumptions and data, no independent source has verified such assumptions. Any trademarks, service marks, trade names and copyrights of the Company and other companies contained in this presentation are the property of their respective owners. DISCLAIMER

4 Black Rifle Coffee is a brand-first company built by Veterans, rooted in authenticity, and grounded in community. WHO WE ARE PILLARS OF BRAND IDENTITY Authenticity Matters Our story is real. The mission is lived, not manufactured, and customers recognize the difference Veteran Founded Built by Veterans who carry the culture, values, and lived experience of the community we serve Premium By Design We deliver high-quality, expertly roasted coffee and experiences that reflect pride in craft and standards Mission in Action We stand for the communities we come from and serve, and we reinvest in them as the business grows

5 Brand-First, Mission-Driven Company with a Deeply Engaged Customer Base Category-Disruptive Coffee Brand with a Disciplined, Return-Focused Strategy Authentic, Veteran-Founded Brand with Credibility That Cannot Be Replicated Experienced Management Team Aligned Around Content, Coffee, and Customers Disciplined Operations and Capital Allocation Designed for Simplicity and Execution WHAT SETS US APART Intentional Focus on Fewer, Higher-Return Priorities

6 FOCUSED ON WHAT WINS We have simplified the business and aligned the organization around a small number of high- impact priorities WE ARE CENTERED ON THREE CORE PRIORITIES OUR APPROACH PRIORITIZES THE FOLLOWING Content Building brand engagement and demand through owned media Coffee Delivering premium products with disciplined portfolio focus Customers / Consumers Driving repeat, loyalty, and lifetime value Simplicity Reducing complexity to improve speed and execution Margin Favoring returns over volume Execution Consistently delivering across channels Brand Momentum Leveraging brand strength to drive velocity

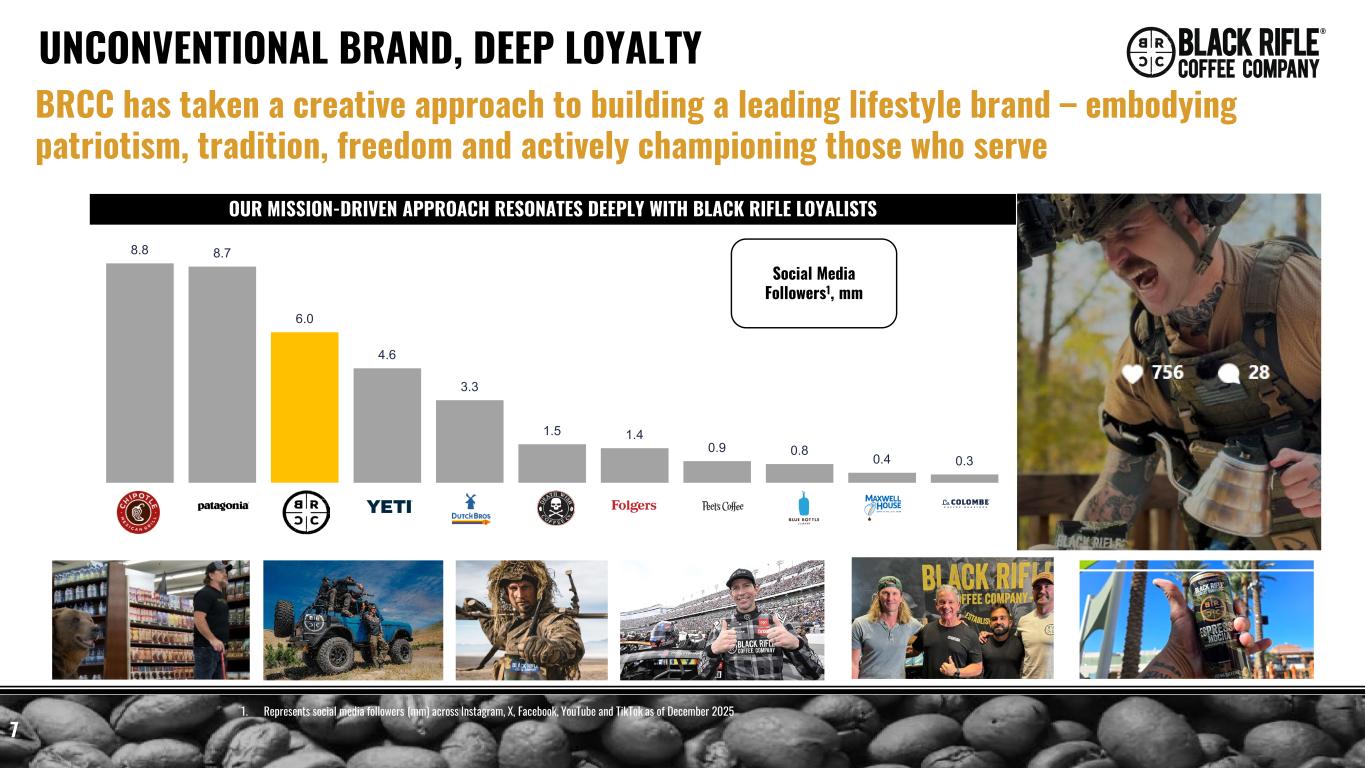

7 UNCONVENTIONAL BRAND, DEEP LOYALTY BRCC has taken a creative approach to building a leading lifestyle brand – embodying patriotism, tradition, freedom and actively championing those who serve OUR MISSION-DRIVEN APPROACH RESONATES DEEPLY WITH BLACK RIFLE LOYALISTS 1. Represents social media followers (mm) across Instagram, X, Facebook, YouTube and TikTok as of December 2025 Social Media Followers1, mm 8.8 8.7 6.0 4.6 3.3 1.5 1.4 0.9 0.8 0.4 0.3

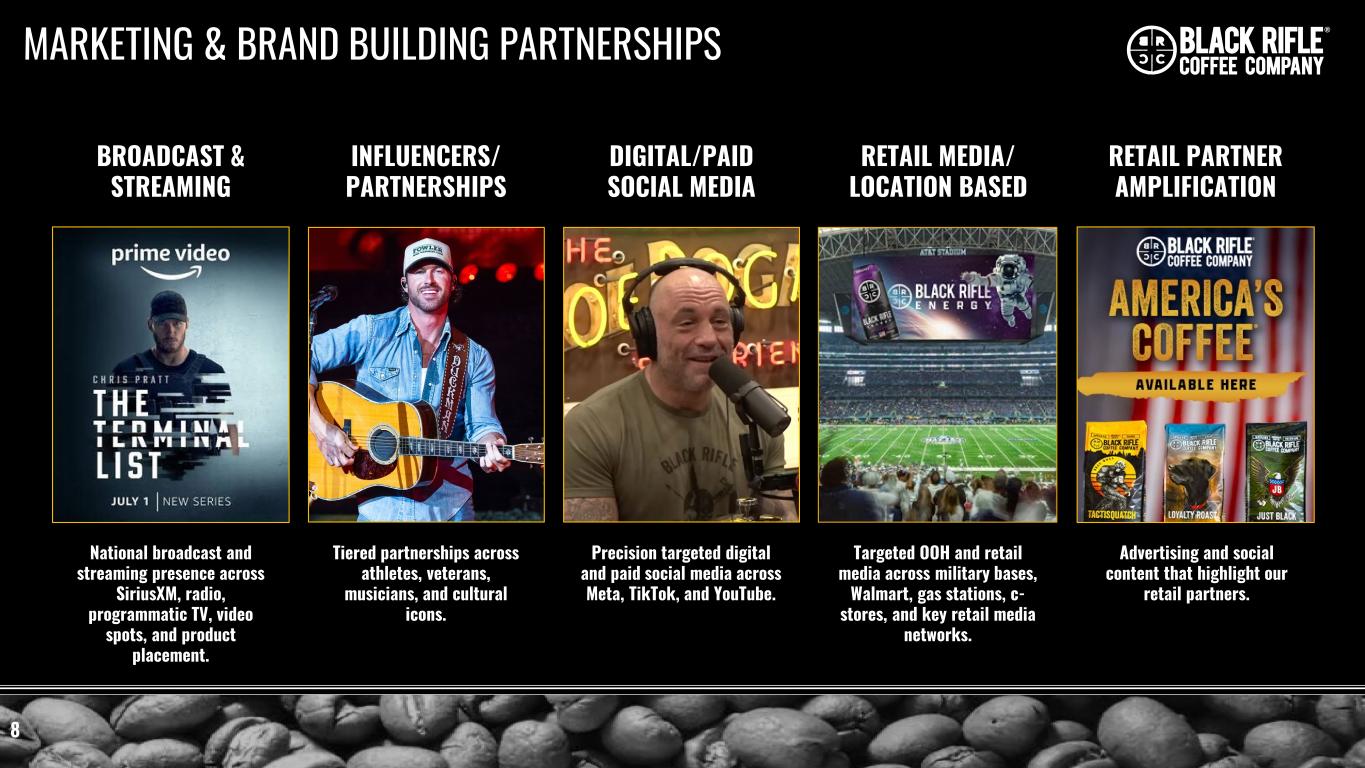

8 MARKETING & BRAND BUILDING PARTNERSHIPS BROADCAST & STREAMING INFLUENCERS/ PARTNERSHIPS DIGITAL/PAID SOCIAL MEDIA RETAIL MEDIA/ LOCATION BASED RETAIL PARTNER AMPLIFICATION National broadcast and streaming presence across SiriusXM, radio, programmatic TV, video spots, and product placement. Tiered partnerships across athletes, veterans, musicians, and cultural icons. Precision targeted digital and paid social media across Meta, TikTok, and YouTube. Targeted OOH and retail media across military bases, Walmart, gas stations, c- stores, and key retail media networks. Advertising and social content that highlight our retail partners.

9 EXPANDING BRAND REACH ACROSS MEDIA, RETAIL, AND LIVE EXPERIENCES Pre-Store Awareness In-Store Intent DIGITAL BANNERS PAID SOCIAL STREAMING TV COLLECTIBLE SWAG OUT OF HOME RILEY GREEN CONCERT SERIES GEORGIA | ALABAMA | NASHVILLE | SLC IN STADIUM ADVERTISING IN STORE DISPLAY 9

10 BLACK RIFLE SOCIAL MEDIA CHANNELS 10 Instagram: https://www.instagram.com/blackriflecoffee/ X: https://x.com/blckriflecoffee Facebook: https://www.facebook.com/blackriflecoffeeco YouTube: https://www.youtube.com/@BlackRifleCoffeeCompany TikTok: https://www.tiktok.com/@blackriflecoffee?lang=en

11 Chris Mondzelewski President & Chief Executive Officer

12 Premium Positioning High-quality sourcing with bold flavor profiles Portfolio designed for multiple consumption occasions Broad accessibility without compromising premium positioning PRODUCT Loyalty & Demand Efficiency Highly differentiated, mission driven brand Connection to shared culture, values, and lifestyle Drives engagement and repeat behavior across channels BRAND Disciplined Expansion Disciplined, consumer-led innovation Focused on adjacencies that reinforce brand credibility New formats launched with clear strategic intent INNOVATION Scalable Distribution Strategic retail partnerships across key retail channels Improved distribution quality, visibility, and in-store execution Scales the business while reinforcing brand positioning STRATEGIC PARTNERSHIPS FOUNDATIONAL CAPABILITIES THAT DRIVE CONSISTENT GROWTH These capabilities support a growth model built on loyalty, discipline, and scale

13 TARGETING ATTRACTIVE BEVERAGE SEGMENTS WITH SHARE UPSIDE ENERGY 1. Nielsen IQ: Latest 52 Weeks – w/e 12/27/25, Total US xAOC 2. Nielsen IQ: Latest 52 Weeks – w/e 12/27/25, Total US xAOC + Convenience 3. Nielsen IQ: Latest 5 Weeks – w/e 12/27/25, Total US xAOC 4. Nielsen IQ: Latest 5 Weeks – w/e 12/27/25, Total US xAOC + Convenience 5. Nielsen IQ: Latest 5 Weeks – w/e 12/27/25, Total US xAOC + Convenience, Single Serve Multi-category growth with meaningful runway for share gains CORE: Large, stable category with opportunity to drive penetration and velocity Category: ~$13B1 Dollar Share: 3.3% Bagged3; 2.2% Pod3 ACV: 49.1% ACV Grocery3, 54.8% ACV xAOC3 SCALE: Early share gains in smaller, but consolidated category Category: ~$4B2 Dollar Share: 4.5% Total US5 ACV: 56.0% ACV – xAOC + Convenience4 EMERGING: Capital light launch with disciplined distribution expansion Category: ~$23B2 Launched in late ‘24, on shelf in January ‘25 ACV: 21.7% ACV – xAOC + Convenience4 PACKAGED COFFEE READY-TO-DRINK COFFEE (RTD)

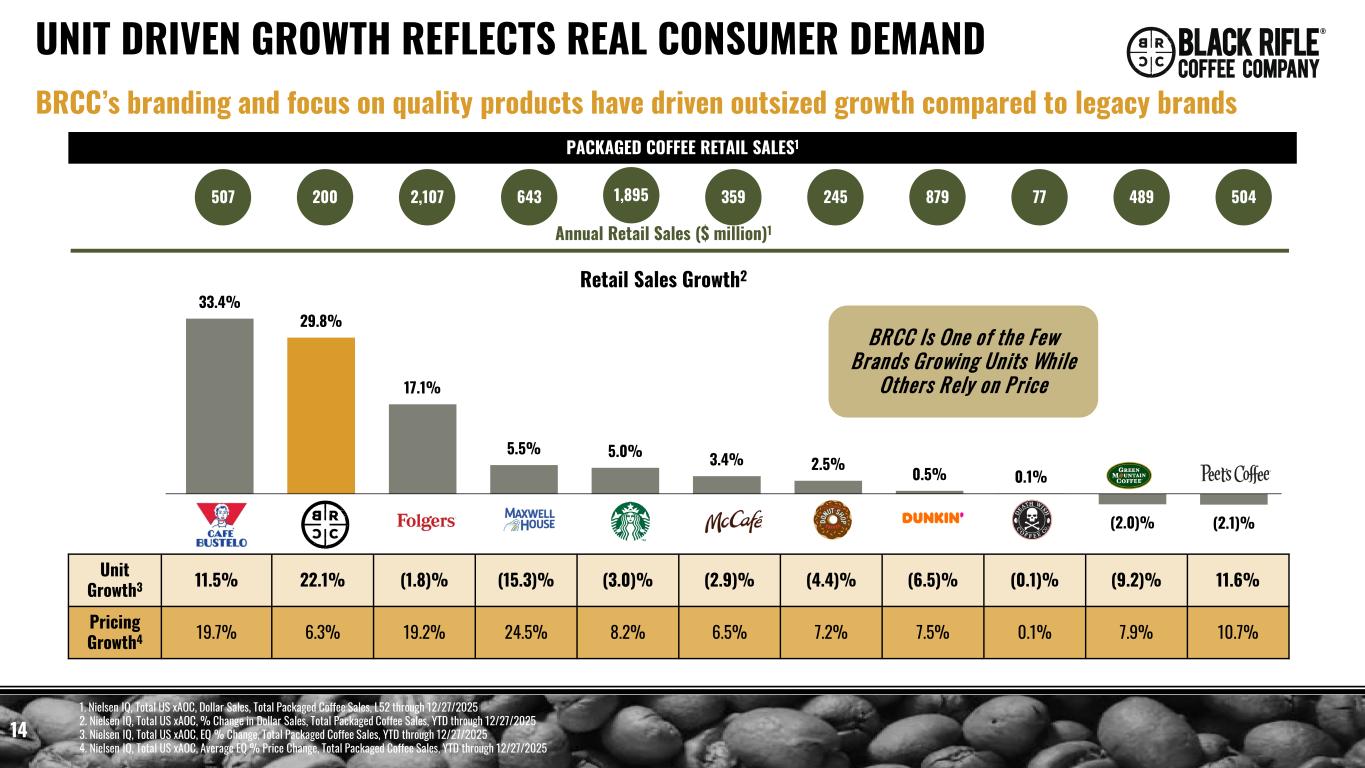

33.4% 29.8% 17.1% 5.5% 5.0% 3.4% 2.5% 0.5% 0.1% (2.0)% (2.1)% 14 UNIT DRIVEN GROWTH REFLECTS REAL CONSUMER DEMAND BRCC’s branding and focus on quality products have driven outsized growth compared to legacy brands PACKAGED COFFEE RETAIL SALES1 507 Annual Retail Sales ($ million)1 200 643 772,107 1,895 245359 489879 504 BRCC Is One of the Few Brands Growing Units While Others Rely on Price Unit Growth3 11.5% 22.1% (1.8)% (15.3)% (3.0)% (2.9)% (4.4)% (6.5)% (0.1)% (9.2)% 11.6% Pricing Growth4 19.7% 6.3% 19.2% 24.5% 8.2% 6.5% 7.2% 7.5% 0.1% 7.9% 10.7% Retail Sales Growth2 1. Nielsen IQ, Total US xAOC, Dollar Sales, Total Packaged Coffee Sales, L52 through 12/27/2025 2. Nielsen IQ, Total US xAOC, % Change in Dollar Sales, Total Packaged Coffee Sales, YTD through 12/27/2025 3. Nielsen IQ, Total US xAOC, EQ % Change, Total Packaged Coffee Sales, YTD through 12/27/2025 4. Nielsen IQ, Total US xAOC, Average EQ % Price Change, Total Packaged Coffee Sales, YTD through 12/27/2025

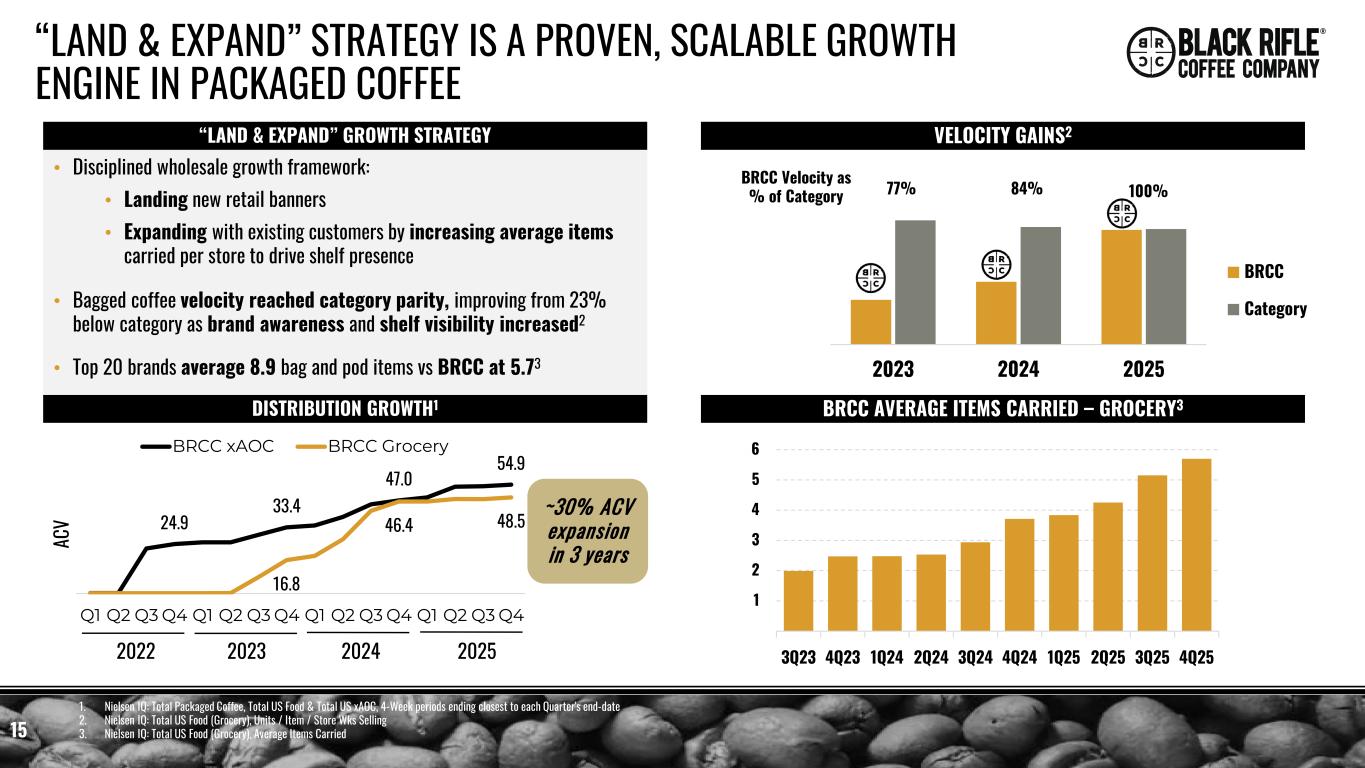

2023 2024 2025 BRCC Category 15 “LAND & EXPAND” STRATEGY IS A PROVEN, SCALABLE GROWTH ENGINE IN PACKAGED COFFEE 1. Nielsen IQ: Total Packaged Coffee, Total US Food & Total US xAOC, 4-Week periods ending closest to each Quarter's end-date 2. Nielsen IQ: Total US Food (Grocery), Units / Item / Store Wks Selling 3. Nielsen IQ: Total US Food (Grocery), Average Items Carried “LAND & EXPAND” GROWTH STRATEGY 24.9 33.4 47.0 54.9 16.8 46.4 48.5 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 AC V BRCC xAOC BRCC Grocery 2022 2023 2024 2025 DISTRIBUTION GROWTH1 • Disciplined wholesale growth framework: • Landing new retail banners • Expanding with existing customers by increasing average items carried per store to drive shelf presence • Bagged coffee velocity reached category parity, improving from 23% below category as brand awareness and shelf visibility increased2 • Top 20 brands average 8.9 bag and pod items vs BRCC at 5.73 ~30% ACV expansion in 3 years VELOCITY GAINS2 BRCC Velocity as % of Category 77% 84% 100% BRCC AVERAGE ITEMS CARRIED – GROCERY3 1 2 3 4 5 6 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25

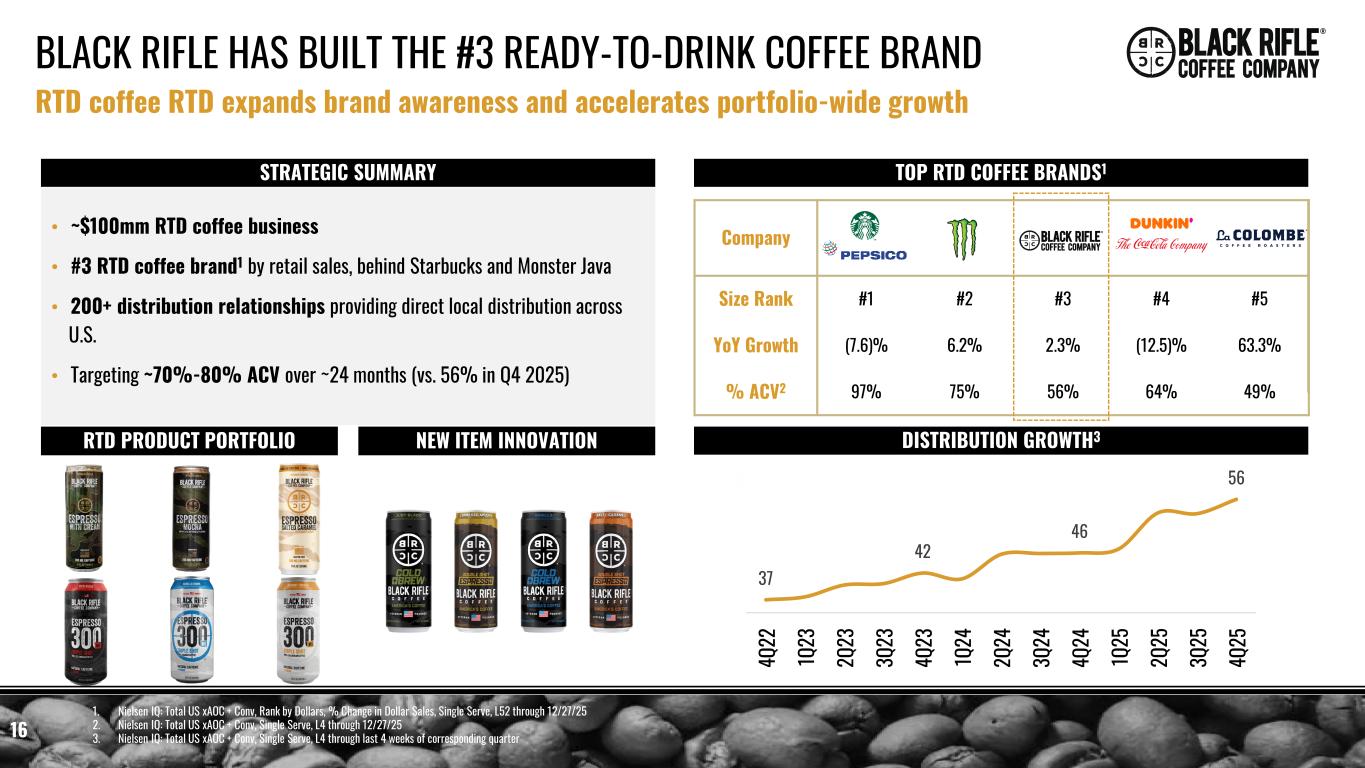

Company Size Rank #1 #2 #3 #4 #5 YoY Growth (7.6)% 6.2% 2.3% (12.5)% 63.3% % ACV2 97% 75% 56% 64% 49% 16 BLACK RIFLE HAS BUILT THE #3 READY-TO-DRINK COFFEE BRAND RTD coffee RTD expands brand awareness and accelerates portfolio-wide growth STRATEGIC SUMMARY RTD PRODUCT PORTFOLIO TOP RTD COFFEE BRANDS1 DISTRIBUTION GROWTH3NEW ITEM INNOVATION • ~$100mm RTD coffee business • #3 RTD coffee brand1 by retail sales, behind Starbucks and Monster Java • 200+ distribution relationships providing direct local distribution across U.S. • Targeting ~70%-80% ACV over ~24 months (vs. 56% in Q4 2025) 37 42 46 56 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 4Q 25 1. Nielsen IQ: Total US xAOC + Conv, Rank by Dollars, % Change in Dollar Sales, Single Serve, L52 through 12/27/25 2. Nielsen IQ: Total US xAOC + Conv, Single Serve, L4 through 12/27/25 3. Nielsen IQ: Total US xAOC + Conv, Single Serve, L4 through last 4 weeks of corresponding quarter

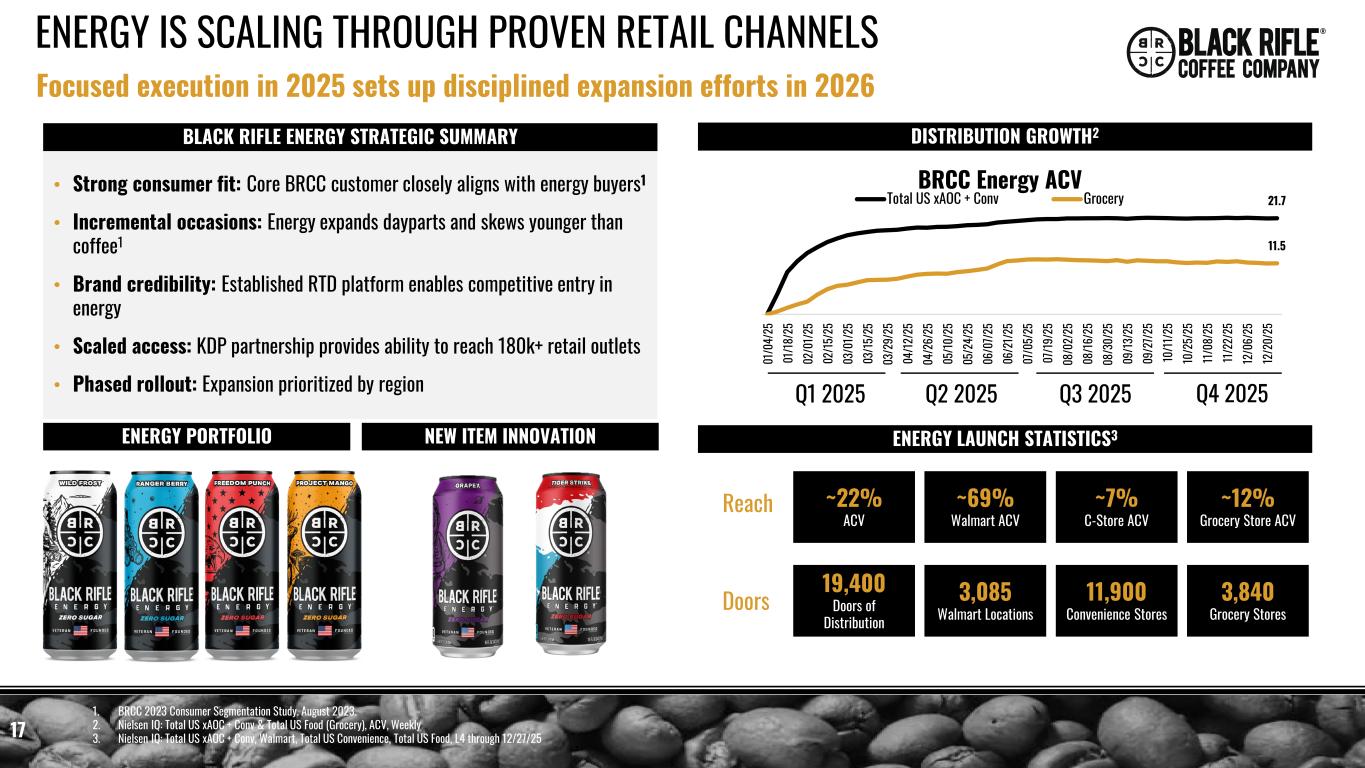

17 ENERGY IS SCALING THROUGH PROVEN RETAIL CHANNELS Focused execution in 2025 sets up disciplined expansion efforts in 2026 ENERGY PORTFOLIO NEW ITEM INNOVATION ~22% ACV 19,400 Doors of Distribution 3,085 Walmart Locations ~69% Walmart ACV 11,900 Convenience Stores ~7% C-Store ACV 3,840 Grocery Stores ~12% Grocery Store ACV ENERGY LAUNCH STATISTICS3 21.7 11.5 01 /0 4/ 25 01 /18 /2 5 02 /0 1/2 5 02 /15 /2 5 03 /0 1/2 5 03 /15 /2 5 03 /2 9/ 25 04 /12 /2 5 04 /2 6/ 25 05 /10 /2 5 05 /2 4/ 25 06 /0 7/2 5 06 /2 1/2 5 07 /0 5/ 25 07 /19 /2 5 08 /0 2/ 25 08 /16 /2 5 08 /3 0/ 25 09 /13 /2 5 09 /2 7/2 5 10 /11 /2 5 10 /2 5/ 25 11/ 08 /2 5 11/ 22 /2 5 12 /0 6/ 25 12 /2 0/ 25 AC V % BRCC Energy ACV Total US xAOC + Conv Grocery Q3 2025Q1 2025 Q2 2025 BLACK RIFLE ENERGY STRATEGIC SUMMARY • Strong consumer fit: Core BRCC customer closely aligns with energy buyers1 • Incremental occasions: Energy expands dayparts and skews younger than coffee1 • Brand credibility: Established RTD platform enables competitive entry in energy • Scaled access: KDP partnership provides ability to reach 180k+ retail outlets • Phased rollout: Expansion prioritized by region DISTRIBUTION GROWTH2 1. BRCC 2023 Consumer Segmentation Study. August 2023. 2. Nielsen IQ: Total US xAOC + Conv & Total US Food (Grocery), ACV, Weekly 3. Nielsen IQ: Total US xAOC + Conv, Walmart, Total US Convenience, Total US Food, L4 through 12/27/25 Q4 2025 Reach Doors

18 Matt Amigh Chief Financial Officer

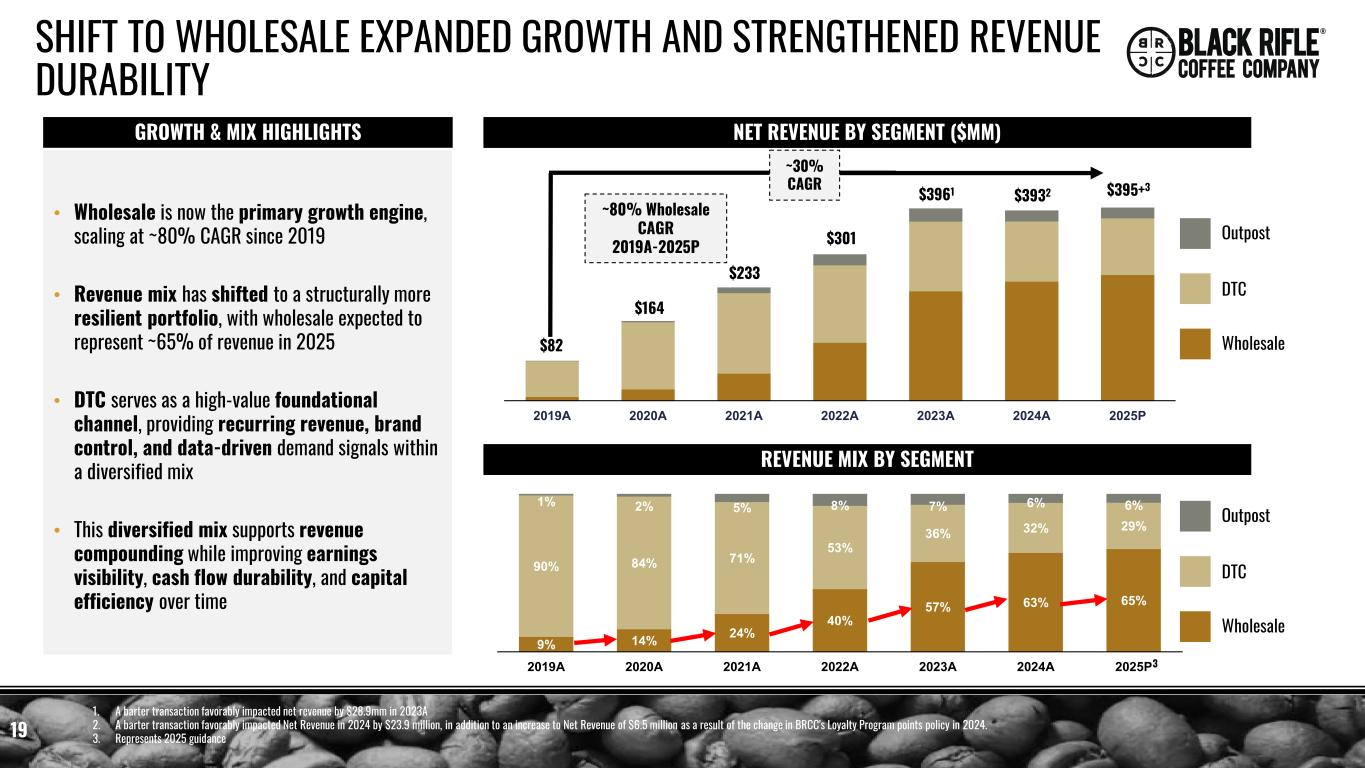

2019A 2020A 2021A 2022A 2023A 2024A 2025P 19 SHIFT TO WHOLESALE EXPANDED GROWTH AND STRENGTHENED REVENUE DURABILITY NET REVENUE BY SEGMENT ($MM) Wholesale DTC Outpost 9% 14% 24% 40% 57% 63% 65% 90% 84% 71% 53% 36% 32% 29% 1% 2% 5% 8% 7% 6% 6% 2019A 2020A 2021A 2022A 2023A 2024A 2025P $3932$3961 $301 $233 $164 $82 ~80% Wholesale CAGR 2019A-2025P ~30% CAGR $395+3 Wholesale DTC Outpost 1. A barter transaction favorably impacted net revenue by $28.9mm in 2023A 2. A barter transaction favorably impacted Net Revenue in 2024 by $23.9 million, in addition to an increase to Net Revenue of $6.5 million as a result of the change in BRCC's Loyalty Program points policy in 2024. 3. Represents 2025 guidance REVENUE MIX BY SEGMENT GROWTH & MIX HIGHLIGHTS • Wholesale is now the primary growth engine, scaling at ~80% CAGR since 2019 • Revenue mix has shifted to a structurally more resilient portfolio, with wholesale expected to represent ~65% of revenue in 2025 • DTC serves as a high-value foundational channel, providing recurring revenue, brand control, and data-driven demand signals within a diversified mix • This diversified mix supports revenue compounding while improving earnings visibility, cash flow durability, and capital efficiency over time 3

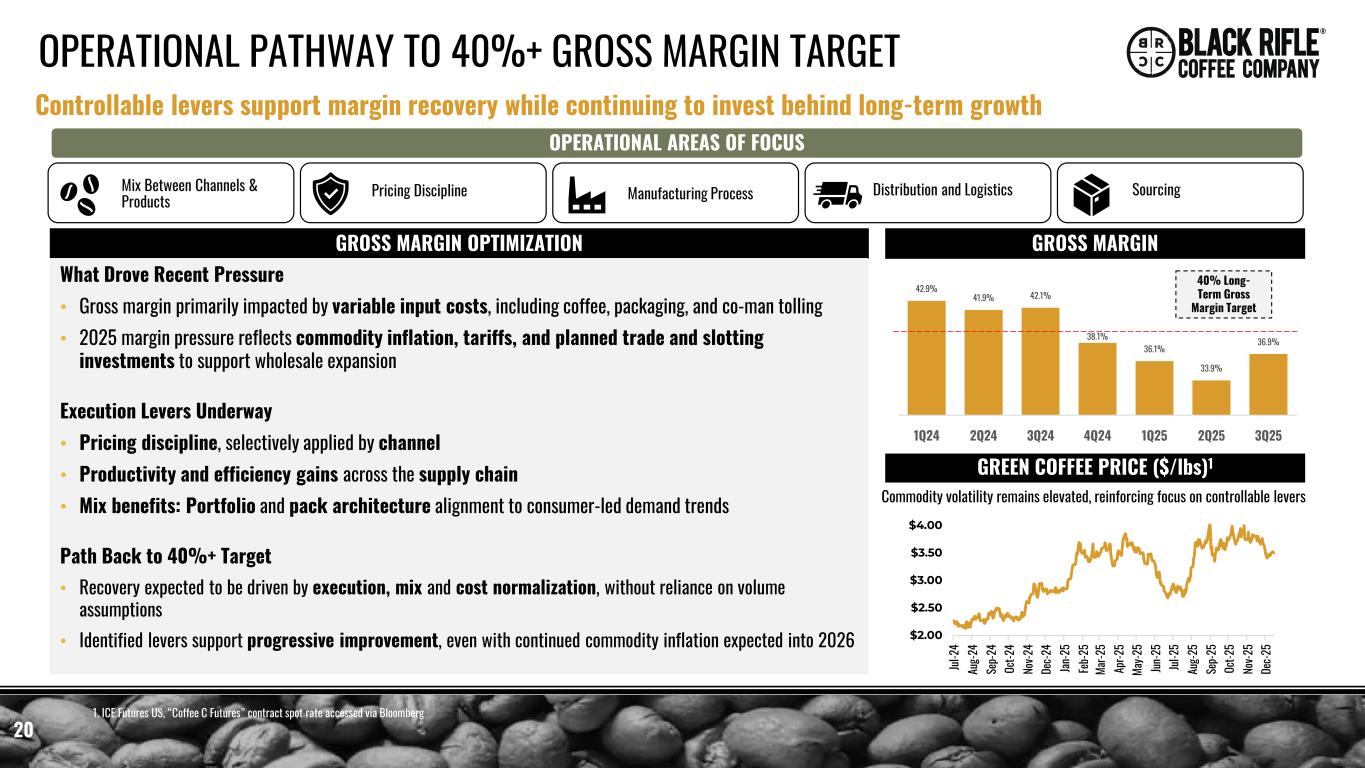

OPERATIONAL PATHWAY TO 40%+ GROSS MARGIN TARGET OPERATIONAL AREAS OF FOCUS Manufacturing ProcessMix Between Channels & Products Distribution and Logistics Sourcing 20 GROSS MARGIN OPTIMIZATION GROSS MARGIN Controllable levers support margin recovery while continuing to invest behind long-term growth What Drove Recent Pressure • Gross margin primarily impacted by variable input costs, including coffee, packaging, and co-man tolling • 2025 margin pressure reflects commodity inflation, tariffs, and planned trade and slotting investments to support wholesale expansion Execution Levers Underway • Pricing discipline, selectively applied by channel • Productivity and efficiency gains across the supply chain • Mix benefits: Portfolio and pack architecture alignment to consumer-led demand trends Path Back to 40%+ Target • Recovery expected to be driven by execution, mix and cost normalization, without reliance on volume assumptions • Identified levers support progressive improvement, even with continued commodity inflation expected into 2026 GREEN COFFEE PRICE ($/lbs)1 1. ICE Futures US, “Coffee C Futures” contract spot rate accessed via Bloomberg Commodity volatility remains elevated, reinforcing focus on controllable levers $2.00 $2.50 $3.00 $3.50 $4.00 Jul -24 Au g-2 4 Se p-2 4 Oc t-2 4 No v-2 4 De c-2 4 Jan -25 Fe b-2 5 Ma r-2 5 Ap r-2 5 Ma y-2 5 Jun -25 Jul -25 Au g-2 5 Se p-2 5 Oc t-2 5 No v-2 5 De c-2 5 42.9% 41.9% 42.1% 38.1% 36.1% 33.9% 36.9% 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 40% Long- Term Gross Margin Target Pricing Discipline

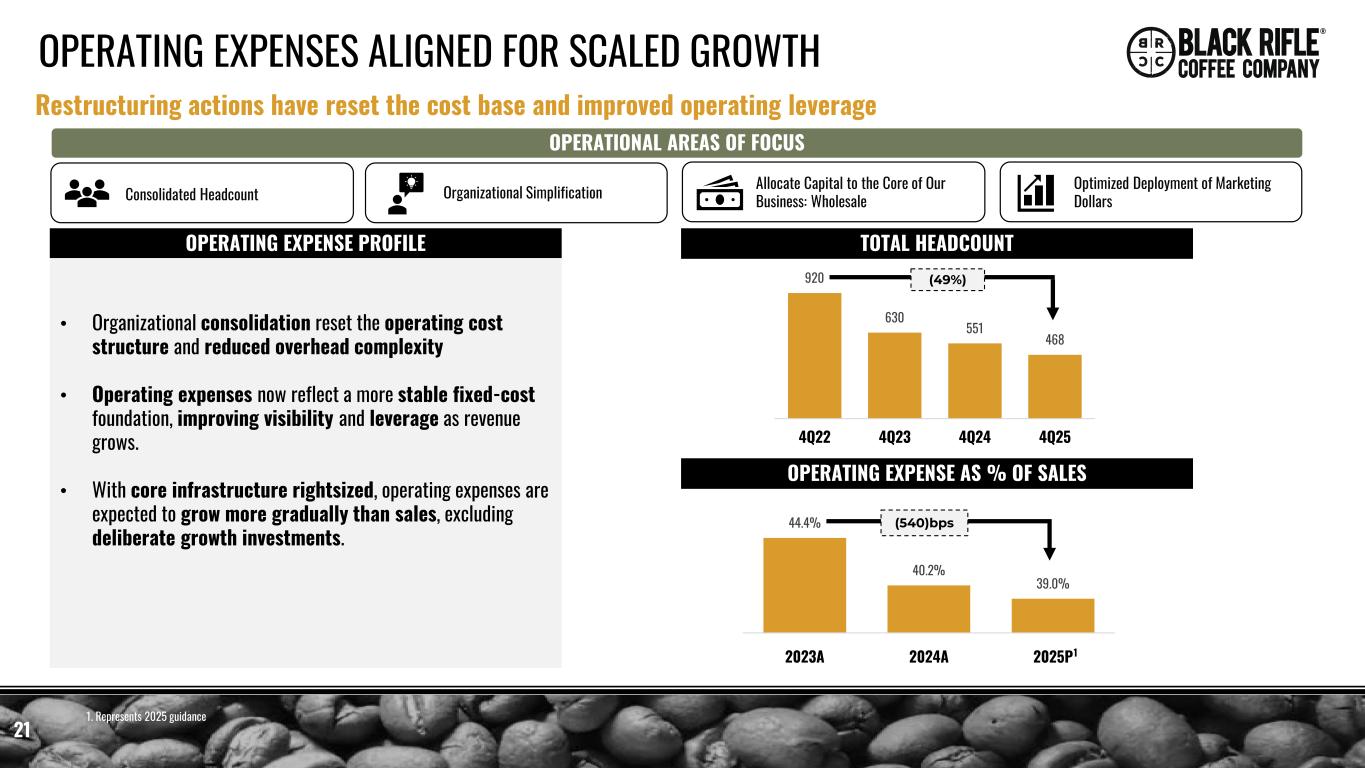

920 630 551 468 4Q22 4Q23 4Q24 4Q25 OPERATING EXPENSES ALIGNED FOR SCALED GROWTH OPERATIONAL AREAS OF FOCUS 21 OPERATING EXPENSE PROFILE Restructuring actions have reset the cost base and improved operating leverage • Organizational consolidation reset the operating cost structure and reduced overhead complexity • Operating expenses now reflect a more stable fixed-cost foundation, improving visibility and leverage as revenue grows. • With core infrastructure rightsized, operating expenses are expected to grow more gradually than sales, excluding deliberate growth investments. OPERATING EXPENSE AS % OF SALES Allocate Capital to the Core of Our Business: Wholesale Optimized Deployment of Marketing DollarsConsolidated Headcount Organizational Simplification (49%) 44.4% 40.2% 39.0% 2023A 2024A 2025P TOTAL HEADCOUNT (540)bps 1 1. Represents 2025 guidance

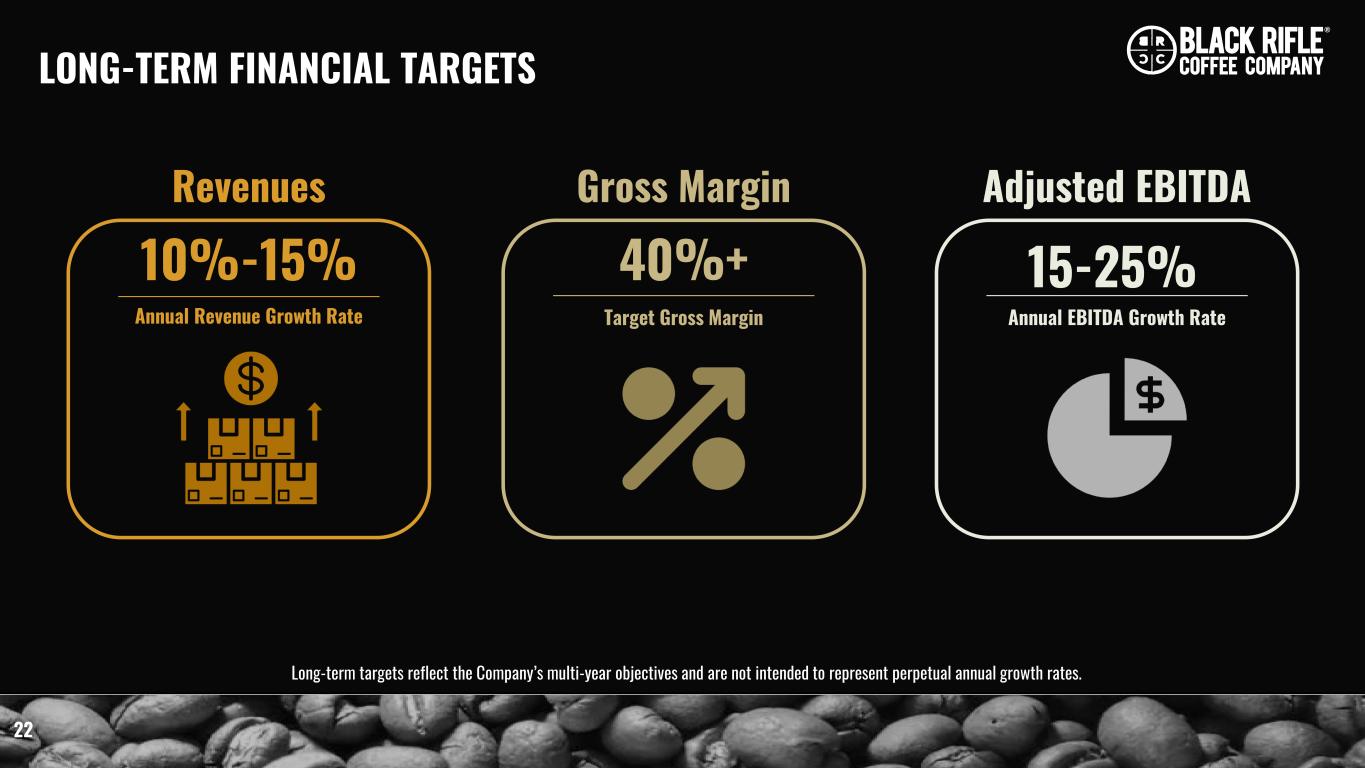

Revenues Gross Margin Adjusted EBITDA 10%-15% Annual Revenue Growth Rate 40%+ Target Gross Margin 15-25% Annual EBITDA Growth Rate 22 LONG-TERM FINANCIAL TARGETS Long-term targets reflect the Company’s multi-year objectives and are not intended to represent perpetual annual growth rates.

23 Thank You!